Blogs > Income Tax Deduction on EPF Contribution: A Complete Guide

Income

Tax Deduction on EPF Contribution: A Complete Guide

The Employees’ Provident Fund (EPF) is one of the

most popular savings schemes in India, designed to help salaried employees

build a retirement corpus. Apart from securing your future, EPF also offers

significant income tax benefits under the Income Tax Act, 1961.

In this guide by IndiaLends, we’ll explain how EPF

contributions are taxed, the deductions you can claim, and important rules

to remember to maximize your savings.

EPF

Contribution Structure

Both you and your employer contribute to your EPF account

every month:

|

Contributor |

Contribution Rate |

Tax Treatment |

|

Employee |

12% of Basic + DA |

Eligible for tax deduction under Section 80C (up to

₹1.5 lakh) |

|

Employer |

12% of Basic + DA |

Employer’s contribution up to 12% of Basic + DA is

tax-free |

Tax

Benefits on EPF Contribution

Here’s how your EPF contributions qualify for tax

deductions:

|

Component |

Tax Benefit |

Relevant Section |

Limit |

|

Employee’s contribution |

Deductible from taxable income |

Section 80C |

₹1.5 lakh per year |

|

Employer’s contribution |

Exempt from tax up to 12% of salary |

Section 17(2) |

Above this limit, taxable |

|

Interest earned |

Tax-free if interest rate ≤ 9.5% p.a. and withdrawal after

5 years |

Section 10(12) |

- |

When EPF

Becomes Taxable

While EPF is usually tax-friendly, it can become taxable in

certain cases:

Example:

Tax Saving Through EPF

If your Basic + DA is ₹30,000/month:

Tips to

Maximize EPF Tax Benefits

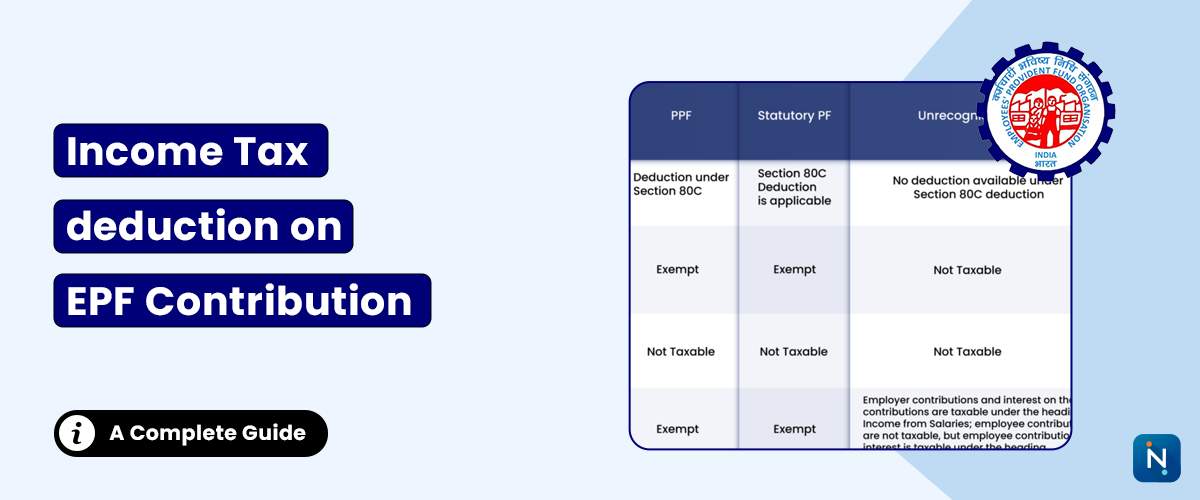

EPF and

Other Tax-Saving Investments

EPF is one of the safest Section 80C investments. You

can combine it with ELSS, PPF, and tax-saving FDs to fully utilize your

₹1.5 lakh annual limit.

If you need funds before retirement, instead of premature

EPF withdrawal (which may trigger taxes), you can opt for an instant personal loan

from IndiaLends.

Frequently

Asked Questions (FAQs)

Q1. Is EPF interest taxable?

EPF interest is tax-free if total employee contribution in a year does not

exceed ₹2.5 lakh and withdrawal is after 5 years of service.

Q2. Can I claim 80C deduction for voluntary contributions

to EPF?

Yes, Voluntary Provident Fund (VPF) contributions are also eligible

under Section 80C, up to ₹1.5 lakh in a year.

Q3. What happens if I withdraw EPF before 5 years?

The withdrawal amount becomes taxable, and TDS may be deducted if the amount

exceeds ₹50,000.

Q4. Is employer’s contribution to EPF always tax-free?

It is tax-free only up to 12% of your Basic + DA and within the combined ₹7.5

lakh annual limit (EPF + NPS + Superannuation).

Q5. Can IndiaLends help me with EPF withdrawal?

IndiaLends does not directly process EPF withdrawals but offers financial

solutions like personal loans to cover urgent needs until your EPF is

released.