Check Your CIBIL Score Online – 100% FREE

Get your credit score and free CIBIL report with detailed analysis in just 1 minute. Track your credit health anytime at zero cost.

An OTP will be sent for verification

Powered by |

Trusted by 2.5 crore Indians |

What is a Credit Score?

A credit score (or CIBIL score is a 3-digit number that represents your creditworthiness. It typically ranges from 300 to 900, with a higher score indicating stronger credit health.

Lenders use your credit score to evaluate how likely you are to repay loans or credit card dues. A good CIBIL score (750 and above) increases your chances of quick approvals, better interest rates, and higher loan or credit card limits.

👉 You can check your credit score online free in just a minute and get your detailed CIBIL report.

Powered By

CIBIL Part Of TransUnion

800- 900 Excellent

This is the highest score bracket. You can expect most lenders to offer desired loan amount as well as high credit limits at the lowest prevailing interest rates. Keep up the good work to maintain your score.

750- 799 Very Good

You have shown responsible borrower behaviour in past. You can expect desired loan amounts as well as medium to high credit limits. It’s important to keep up the good work to ensure your profile is remains strong.

700- 749 Good

Your profile may be viewed favourable by some lenders. However, you should expect desired loan amounts at higher interest rates and lower credit limits. Take immediate steps to improve your score further.

650- 699 Fair

This indicates that you have not followed the credit terms offered to you in the past. You can expect limited loan options with high interest rates. You should consider immediate steps to improve your score.

300- 649 Poor

You would likely find very few credit providers offering a credit product to you. You can expect lower amounts at higher interest rates. It is advised to opt for Credit Score improvement initiatives to improve your Credit Profile.

Why is Your Credit Score Important?

Your credit score (CIBIL score) plays a crucial role in shaping your financial opportunities. Here’s why maintaining a good score matters:

Loan approvals

- A high CIBIL score signals responsible borrower behaviour.

- Increases your chances of quick personal loan and home loan approvals.

Better interest rates

- Lenders consider applicants with a good credit score as low-risk.

- This often translates into lower interest rates and better loan terms.

Job opportunities

- Many top companies now include a credit score check in background verification.

- A higher score reflects financial discipline, improving employment prospects.

Rental applications

- Some landlords request a credit score report before renting their property.

- A strong score demonstrates reliable payment behaviour and builds trust.

Credit Card Approvals

- A good credit score online check improves your eligibility for top credit cards in India

- Helps you qualify for lifetime free credit cards, premium cards, and higher credit limits

Components of a Credit Score

How can you improve your credit score?

Make Timely Payments

Pay your EMIs and credit card bills on or before the due date. Consistent payments build a strong credit history.

Maintain Low Credit Utilisation

Keep your credit utilisation ratio below 30%. Using too much of your available credit signals risk to lenders.

Avoid Frequent Applications

Too many loan or credit card applications create multiple hard inquiries, which can negatively impact your CIBIL score.

Maintain a Healthy Credit Mix

Balance secured loans (like home/auto loans) with unsecured loans (like personal loans/credit cards) to show financial stability.

Frequently Asked Questions

-

A CIBIL score is a 3-digit number between 300 and 900 that reflects your creditworthiness, based on your credit history maintained by TransUnion CIBIL. It is one of the most important factors lenders consider when deciding whether to approve your loan or credit card application.

- High Score (750+)Better chances of quick approval, lower interest rates, and higher credit limits.

- Average Score (650–749)Approval possible, but with stricter conditions or higher interest.

- Low Score (<650) Higher chances of rejection or restricted loan offers.

-

The best CIBIL score is usually 750 or above. Lenders see this as a sign of strong financial discipline.

- 750–900: Excellent – Strong chance of loan approval at the lowest rates.

- 700–749: Good – Loans may be approved, but terms may vary.

- 650–699: Fair – You may face limited credit options.

- Below 650: Poor – Loan and card applications are likely to be rejected.

-

You can get free credit score checks in multiple ways:

- Official CIBIL website – Offers one free CIBIL report every year.

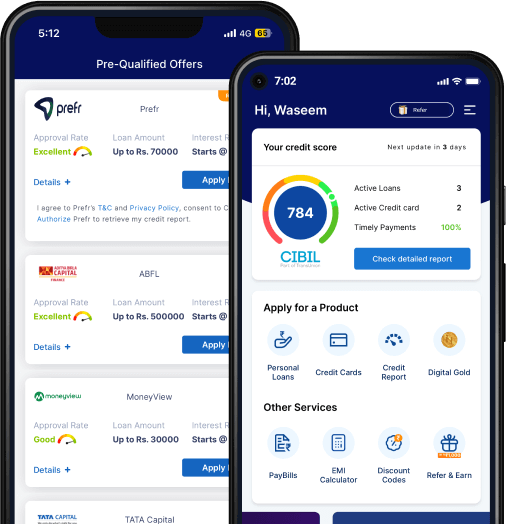

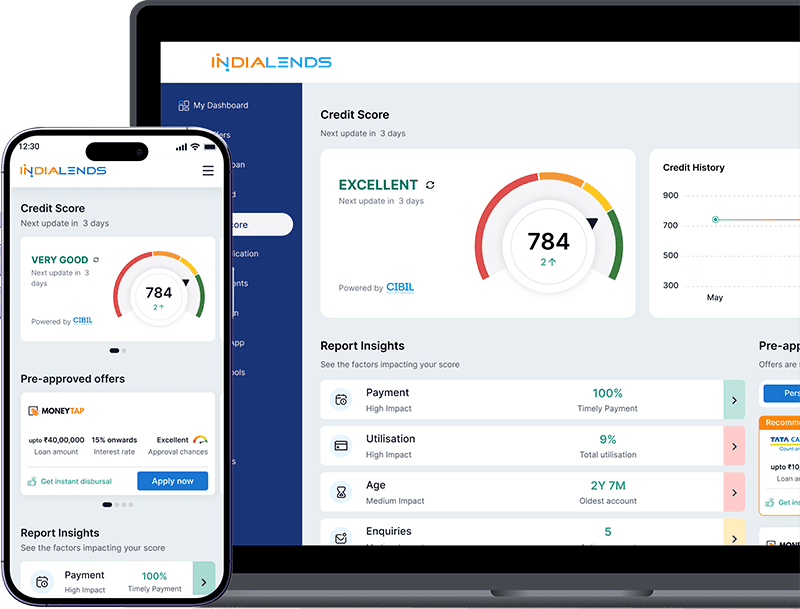

- Fintech platforms like IndiaLends – Provide free credit score checks with monthly updates.

- Banks & NBFCs – Many banks now let you view your credit score in their app or net banking.

Checking regularly helps you stay aware of your credit health and catch errors in your report.

-

You should check your CIBIL score online at least once every 3 months. For active credit users (with multiple loans or cards), monthly checks are better.

- Quarterly checks help you track trends.

- Monthly checks let you catch sudden drops caused by late payments or high utilisation.

Most fintech apps now allow unlimited free credit score checks with instant updates.

-

No. Checking your credit score on your own (via a CIBIL check online) is a soft inquiry and has no impact on your score.

- Soft Inquiry When you check your score for yourself – does not reduce points.

- Hard Inquiry: When banks/lenders check your score during a loan/credit card application – may reduce your CIBIL score by a few points temporarily.

-

Your CIBIL score is calculated based on five main components:

- Payment History (35%) – Timely EMIs and bills have the highest impact.

- Credit Utilisation (30%) – Keep below 30% of your total credit limit.

- Length of Credit History (15%) – Longer history builds trust.

- Credit Mix (10%) – A balance of secured and unsecured loans.

- New Credit Enquiries (10%) – Fewer applications are better.

-

Yes, with consistent effort:

- Pay EMIs and bills on time – Avoid delays to improve your credit score.

- Reduce high balances – Keep utilisation under 30%.

- Don’t apply for multiple loans/cards at once – Too many hard checks lower your score.

- Check your free CIBIL report – Spot and correct errors that may be dragging your score down.

On average, noticeable improvement in your credit score can take 3–6 months.

-

You can download a free CIBIL report once a year directly from the [TransUnion CIBIL website].

Steps include:- Enter your PAN and personal details.

- Verify with OTP or email.

- Download your free credit report in PDF format.

Alternatively, fintech platforms like IndiaLends allow unlimited free credit score checks with monthly updated reports.

-

If your CIBIL score is low:

- Your loan/credit card applications may be rejected.

- You may only get offers at higher interest rates.

- You may face lower credit limits and stricter approval conditions.

Steps to fix it:

- Make timely payments.

- Pay off overdue balances.

- Avoid applying for too much credit at once.

- Monitor your progress by doing a CIBIL check online regularly.

-

Improving to the best CIBIL score (750+) takes time.

- If you already have credit history, disciplined usage can improve it in 6–12 months.

- If you’re new to credit, it may take 12–18 months of consistent payments and responsible usage.

Tips:

- Keep older accounts active.

- Maintain a good credit mix.

- Always check your free CIBIL report to track growth.