List of IFSC code, MICR code and addresses of all bank branches in India.

Find verified IFSC codes quickly to use for NEFT, RTGS & IMPS transactions.

Locate any details of banks branch in India

FSC is an acronym for Indian Financial System Code. It is an 11-digit unique number of alphabets and numerals that uniquely identifies a bank branch. The IFSC is mainly used to transfer funds online for NEFT, IMPS, or RTGS transactions.

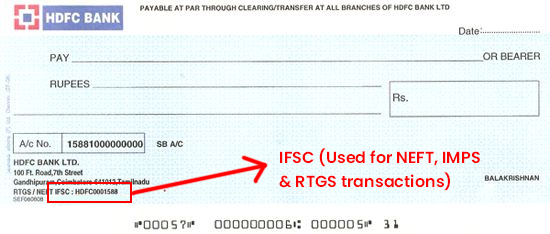

The IFSC code of the respective branch is mentioned in the chequebook of the account holder or on the front page of the passbook. Moreover, an account holder can check the code of their bank branch on the website of Reserve Bank of India.

It is to be noted that IFSC plays a very important role in online fund transfer. Internet banking transactions for transferring funds cannot be initiated without a valid Indian Financial System Code. Also, the 11-digit IFSC code is generally not changed or updated subject to any merger or any official need. Recently, the State Bank of India changed the IFSC of all the branches after the merger with five associate banks and Bhartiya Mahila Bank.

When you look at an IFSC code, the first 4 characters represent the bank. These are generally the characters of the bank itself. For example, the IFSC code of PNB starts with ‘PUNB’ which is the first three letters of the bank’s full name(Punjab National Bank). Similarly, the IFSC code of HDFC starts with ‘HDFC’.

The fifth character is 0(zero) and is reserved for future use.

The last six characters of the code represent the respective branch. They are generally numbers but sometimes can also include alphabets depending on the bank.

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| Bank Code | 0 | Branch Code | ||||||||

Let’s now take an example of a specific IFSC to easily understand the format of an IFSC code. The IFSC code of Federal bank of Kochi branch is FDRL0001033. As per the format given above, the following is what we can make of it.

| F | D | R | L | 0 | 0 | 0 | 1 | 0 | 3 | 3 |

| Bank Code of Federal Bank | 0 | Branch Code of Federal Bank Kochi Branch | ||||||||

In here, FDRL represents the bank name, i.e Federal Bank.

The 5th character is 0, which is for future use

The other 6 characters, 001033 represents the branch of the respective bank, which is Kochi branch in here

By now, you know that IFSC code is required for any kind of electronic fund transfer. When a fund transfer is initiated to a particular payee, the IFSC code helps in avoiding any errors that could happen otherwise. In other words, once the remitter enters all the details and IFSC code, money is sent directly to the correct bank account with the help of IFSC code.

The Reserve Bank of India’s National Clearing Cell monitors all financial transaction between the banks; IFSC codes help them track the transactions and execute fund transfer without any errors.

Moreover, IFSC code can be used to purchase mutual funds and insurance through net banking.

As mentioned, IFSC code can be found in the chequebook and on the front page of the passbook. The account holder can also look for the code in the monthly account statement. Which is why IFSC code plays an important role in financial transactions and why it is unique.

Here are a few reasons why we need IFSC code when making financial transactions:

Nowadays, most of the people are opting for an online process to transfer fund as it is easy and hassle-free. Moreover, it saves your time of going to the bank and standing in the queue. Follow these simple steps to transfer money using IFSC code.

The Magnetic Ink Character Recognition, also known as the MICR Code, is the magnetic inks code printed on the bottom of your bank's cheque leaves. When in 1980s, Reserve Bank of India introduced many new modes for safe and effective payments across the country, the MICR was one of them.

The MICR code helps keep your transactions safe and protected. Additionally, it is an important part of the online money transfers. Every bank branch has a unique MICR code and this helps the RBI to identify the bank branch and process the transactions faster.

The MICR Code is generally found on the bottom half of the bank’s cheque leaf. The code is written in a thin strip at the bottom of the cheque, right next to the cheque number. Additionally, the MICR Code of your bank branch can also be searched online, or inquired at the bank.

In short, the IFSC code is used to initiate electronic money transfer between banks within India. The MICR code, on the other hand, is Magnetic Ink Recognition technology for making cheque processing faster and easier. Additionally, the IFSC code is an 11 character alphanumeric code, whereas the MICR is a 9 digit numeric code.

The MICR is a character recognition technology to help in faster processing of the cheques. Since every bank branch is given a unique MICR code, it helps identify the bank branch and speed up the cheque clearing process. This way all cheques can be cleared faster and everyone receives their money in time.

With the advancement in digitization, everything now has become dependant on the online world. Moreover, this online trend has opened the world for online payment modes. We all agree that online transfer of funds has eased our lives. Nowadays, every other bank is providing Immediate Payment Service(IMPS), NEFT(National Electronic Funds Transfer), and RTGS(Real Time Gross Settlement), and more.

The different parameters such as service availability and flexibility, the speed of transfer, transaction value, etc. also depend on determining the mode of online transfer. These payment methods have their own set of benefits and limitations.

The bank charges for NEFT are very minimal. These can be as follows:

| Amount | NEFT Charges |

| Amounts above ₹10,000 and upto ₹1 lakh | ₹2.50 + Applicable GST |

| Amounts upto ₹10,000 | ₹5 + Applicable GST |

| Amounts above ₹1 lakh and upto ₹2 lakh | ₹15 + Applicable GST |

| Amounts above ₹2 lakh and upto ₹5 lakh | ₹25 + Applicable GST |

| Amounts above ₹5 lakh and upto ₹10 lakh | ₹25 + Applicable GST |

The bank charges for RTGS are minimal. They are as follows:

| Amount | RTGS Charges |

| Amounts above ₹2 lakh and upto ₹5 lakh | ₹25 + Applicable GST |

| Amounts above ₹5 lakh and upto ₹10 lakh | ₹50 + Applicable GST |

The banks charge a minimal fee for the facilitation of IMPS transactions. These charges are as follows:

| Amount | IMPS Charges |

| Amounts upto ₹10,000 | ₹5 + Applicable GST |

| Amounts above ₹10,000 and upto ₹1 lakh | ₹5 + Applicable GST |

| Amounts above ₹1 lakh and upto ₹2 lakh | ₹15 + Applicable GST |