Income

Tax Deduction on EPF Withdrawal: Rules, Rates, and Tips

The Employees’ Provident Fund (EPF) is designed to

provide long-term financial security to salaried employees in India. While EPF

contributions offer tax benefits, withdrawing your EPF before completing 5

years of continuous service can attract tax deductions.

In this guide by IndiaLends, we’ll explain when EPF

withdrawals are taxable, how TDS on EPF withdrawal works, and tips to

avoid unnecessary tax outgo.

When is

EPF Withdrawal Tax-Free?

EPF withdrawals are completely tax-free if:

When is

EPF Withdrawal Taxable?

Your EPF withdrawal becomes taxable if:

In such cases:

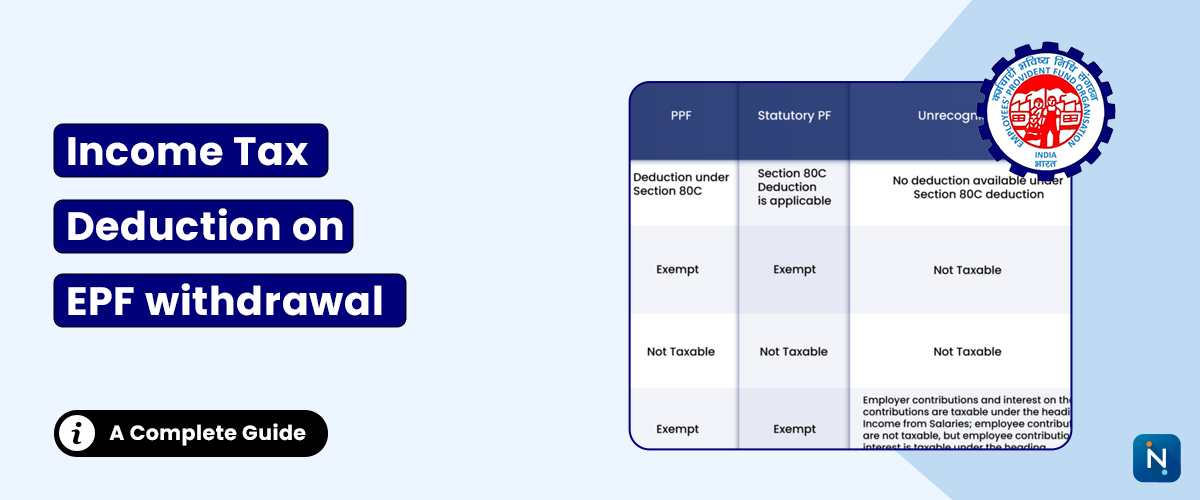

TDS on

EPF Withdrawal Before 5 Years

Here’s a quick reference table:

|

Withdrawal Amount |

TDS Rate |

Conditions |

|

Less than ₹50,000 |

No TDS |

Still taxable if before 5 years |

|

₹50,000 or more |

10% TDS |

If PAN is provided |

|

₹50,000 or more |

30% TDS + cess |

If PAN not provided |

Note: No TDS if the withdrawal is due to illness,

closure of company, or termination beyond your control.

How to

Avoid TDS on EPF Withdrawal

Example

of Tax Deduction on EPF Withdrawal

If you worked for 3 years and your total EPF balance

is ₹2,00,000:

EPF

Withdrawal vs Personal Loan

Withdrawing EPF early can reduce your retirement corpus and

may trigger taxes. If you need funds urgently, a personal loan from

IndiaLends can be a smarter alternative, offering quick disbursal

without affecting your EPF savings.

Frequently

Asked Questions (FAQs)

Q1. Is EPF withdrawal after 5 years taxable?

No, it is completely tax-free if withdrawn after 5 years of continuous service.

Q2. How can I avoid TDS on EPF withdrawal?

Submit Form 15G/15H (if eligible) and ensure PAN is linked to your EPF account.

Q3. What happens if I withdraw EPF before 5 years?

It becomes taxable, and TDS will be deducted if withdrawal is ₹50,000 or more.

Q4. Is there TDS on EPF withdrawal of ₹40,000?

No TDS, but it will still be taxable if withdrawn before 5 years of service.

Q5. Can IndiaLends help me withdraw EPF?

IndiaLends does not process EPF withdrawals but can help you get instant

personal loans to cover urgent needs without touching your EPF savings.