EPF Form

11: Declaration Form for New Employees

When you

join a new job in an organisation covered under the Employees’ Provident Fund

(EPF) scheme, one of the first forms you’ll be asked to fill is EPF Form 11.

This form helps your employer determine whether you are already a member of the

EPF scheme and whether a new Universal Account Number (UAN) needs to be

generated.

This blog by

IndiaLends explains what EPF Form 11 is, when it’s required, how to

fill it, and why it’s important for seamless EPF transfers.

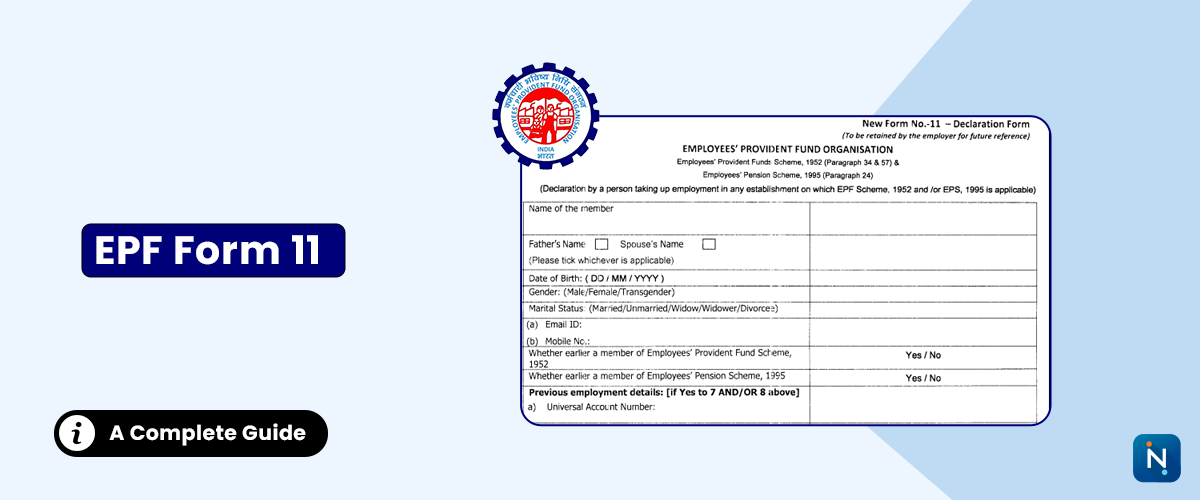

What is

EPF Form 11?

EPF Form 11

is a self-declaration form that every new employee must submit when

joining an establishment covered under the EPF Act, 1952.

It serves

two main purposes:

Key

Details Required in EPF Form 11

|

Section |

Information

Needed |

|

Personal

Information |

Name, Date

of Birth, Gender, Father’s/Husband’s name, Marital Status, Email ID, Mobile

number |

|

Previous

Employment Details |

UAN, PF

member ID, Date of exit from previous employer, Reason for leaving |

|

KYC

Details |

Aadhaar

number, PAN number, Bank account details |

|

Declaration |

Whether

the employee is already an EPF member, EPS member, or exempted under the

scheme |

When is

EPF Form 11 Required?

|

Scenario |

Why

Required |

|

Joining

first job |

To create

a new UAN |

|

Switching

jobs |

To update

PF details and transfer EPF balance |

|

Reactivating

dormant PF account |

To re-link

KYC details with EPF |

How to

Fill EPF Form 11

Step 1: Download the EPF Form 11 PDF from the EPFO website.

Step 2: Fill in personal details and KYC details accurately.

Step 3: Provide details of your previous EPF account (if applicable).

Step 4: Sign the declaration and submit it to your HR or employer.

Step 5: Employer will attest and submit to EPFO.

Documents

Required

Benefits

of EPF Form 11

IndiaLends

Tip

While EPF is

a great way to save for retirement, it’s not designed for urgent financial

needs. If you need instant funds, you can check personal loan offers on

IndiaLends with quick approvals and minimal paperwork.

FAQs on

EPF Form 11

Q1. Is it

mandatory to submit EPF Form 11 when joining a new company?

Yes, it’s mandatory for all new employees in EPF-covered organisations.

Q2. Can I

fill EPF Form 11 online?

Currently, it’s submitted offline via your employer, but details are updated on

the UAN Member Portal.

Q3. What

if I don’t have a UAN when filling Form 11?

A new UAN will be generated for you by EPFO through your employer.

Q4. Can

EPF Form 11 be used for PF transfer?

Yes, if you opt for automatic transfer, a separate Form 13 is not required.

Q5. Do I

need to submit KYC documents with EPF Form 11?

Yes, Aadhaar, PAN, and bank details are required for verification.