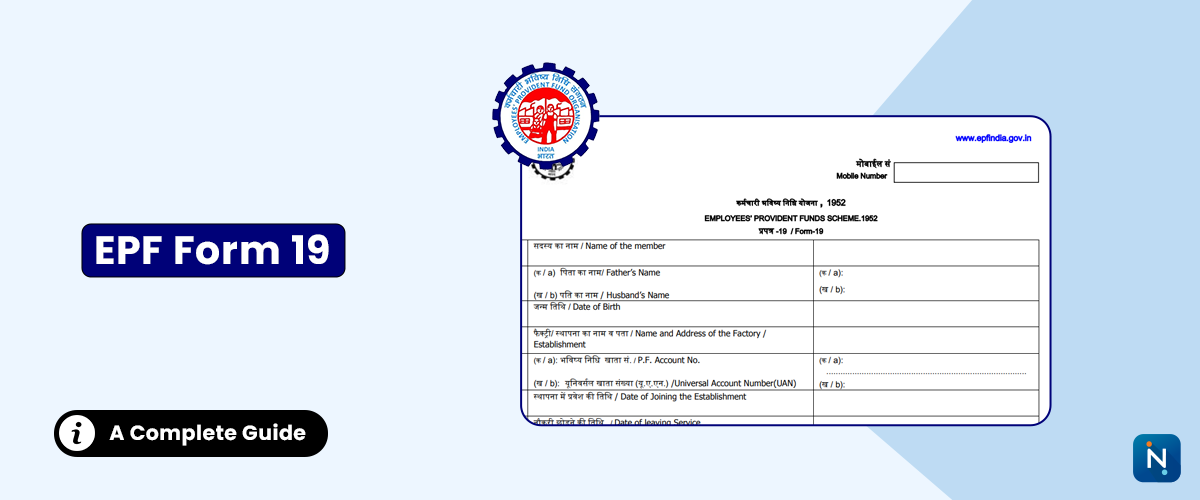

EPF Form

19: How to Withdraw Your Provident Fund Balance

If you have

left your job and want to withdraw your accumulated Employees’ Provident Fund

(EPF) balance, EPF Form 19 is the form you’ll need. This form allows EPF

members to claim the final settlement of their PF account from the Employees’

Provident Fund Organisation (EPFO).

In this

blog, IndiaLends explains what EPF Form 19 is, who can use it, how to

fill it, and important points to keep in mind before applying.

What is

EPF Form 19?

EPF Form 19

is an application form for final settlement of your PF balance when you

leave your job, retire, or are unemployed for more than two months.

It can be

submitted online through the EPFO Member Portal or offline via your employer.

Who Can

Use EPF Form 19?

|

Eligibility

Criteria |

Details |

|

Job

Resignation |

Member has

resigned from the organisation and does not plan to work for at least two

months. |

|

Retirement |

Member has

reached retirement age (58 years). |

|

Employment

Abroad |

Member is

moving permanently outside India. |

|

Permanent

Disablement |

Member is

unable to work due to disability. |

Details

Required in EPF Form 19

|

Section |

Information

Needed |

|

Personal

Details |

Name,

Father’s/Husband’s Name, Date of Birth, Contact Number |

|

Employment

Details |

Establishment

code, PF account number, Date of joining and leaving |

|

Bank

Details |

Account

number, IFSC code (should match with KYC in EPFO records) |

|

Reason for

Leaving |

Retirement,

resignation, disablement, or other applicable reason |

How to

Fill EPF Form 19 Online

Step 1: Log in to the EPFO Member Portal

using your UAN and password.

Step 2: Go to Online Services → Claim (Form-31, 19, 10C).

Step 3: Verify KYC details.

Step 4: Select "PF Final Settlement (Form 19)".

Step 5: Enter bank details and submit your claim.

Documents

Required

Things to

Remember Before Submitting EPF Form 19

IndiaLends

Tip

Withdrawing

your EPF should be a last resort as it impacts your retirement savings. If you

need urgent funds, explore personal loan offers on IndiaLends with quick

approval and minimal paperwork.

FAQs on

EPF Form 19

Q1. Can I

submit EPF Form 19 offline?

Yes, by submitting a filled form to your ex-employer, who will forward it to

EPFO.

Q2. How

long does it take to process EPF Form 19 claims?

Usually 10–15 working days if all KYC and bank details are correct.

Q3. Is it

mandatory to submit Form 15G with EPF Form 19?

Only if your withdrawal is taxable and you want to avoid TDS deduction.

Q4. Can I

withdraw EPF before 2 months of unemployment?

Only in cases like medical emergencies, retirement, or permanent disablement.

Q5. What

happens if bank details don’t match KYC records?

Your claim may be rejected; ensure details are updated before applying.