Income Tax e-Filing is the process of submitting Income Tax returns online to the Government Tax Authorities in the prescribed format. As per the existing Income Tax Rules in India, e-filing is currently mandatory for most tax assessees and replaces the paper-based process of filing ITR.

Top Income Tax E-filing options in India:

Process to e-File ITR on the website of Income Tax Department

Step 1

Visit the Income Tax Department website.

Step 2

Register in case you are a new user or login if you already an existing user.

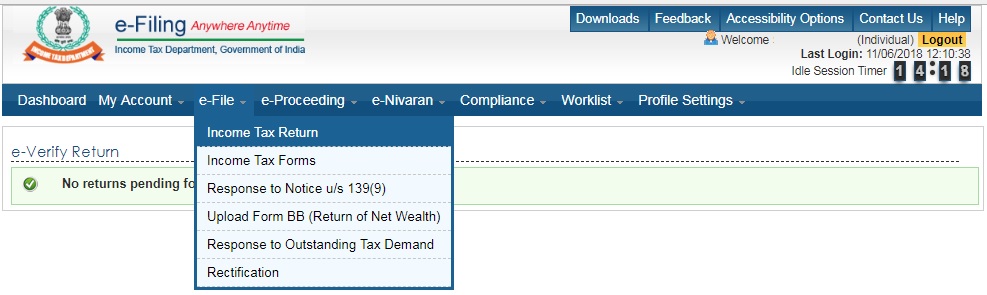

Step 3

In the “e-File” drop-down menu, select the “Income Tax Return” option.

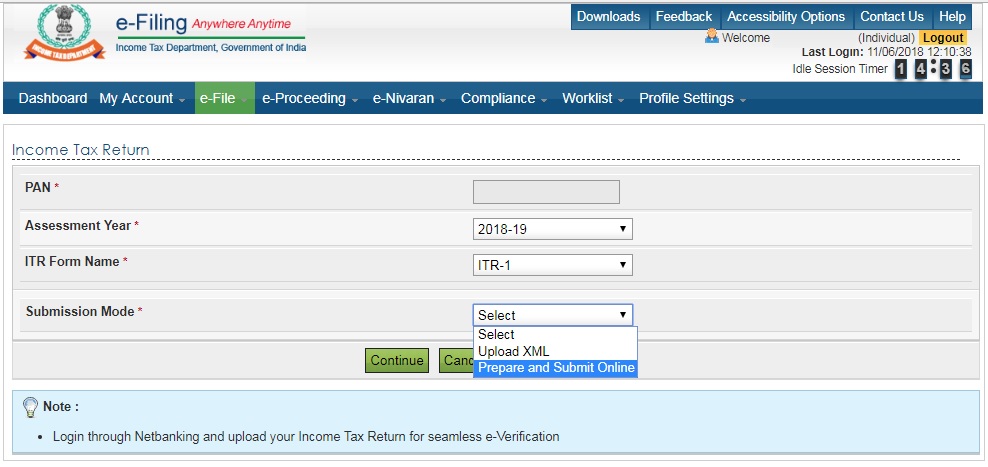

Step 4

Select the assessment year, ITR form type and submission mode.

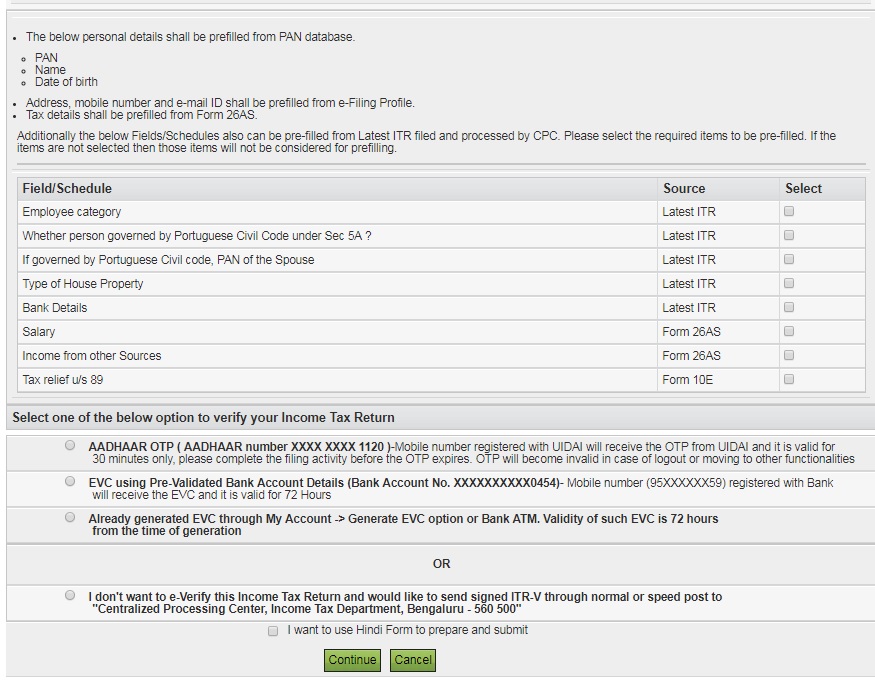

Step 5

Select the authentication type from Aadhaar OTP, EVC or send ITR V through post and click on continue.

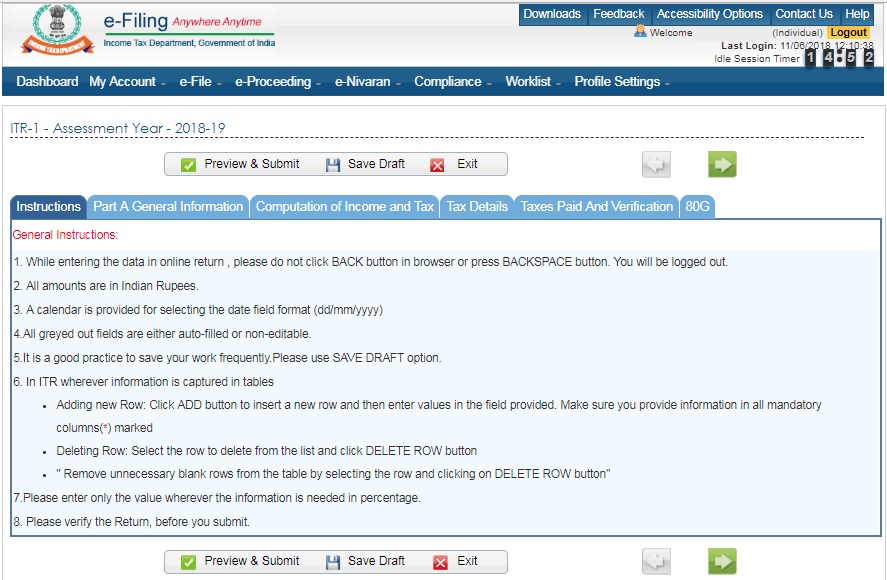

Step 6

Read the instructions carefully before starting the e-Filing process.

Step 7

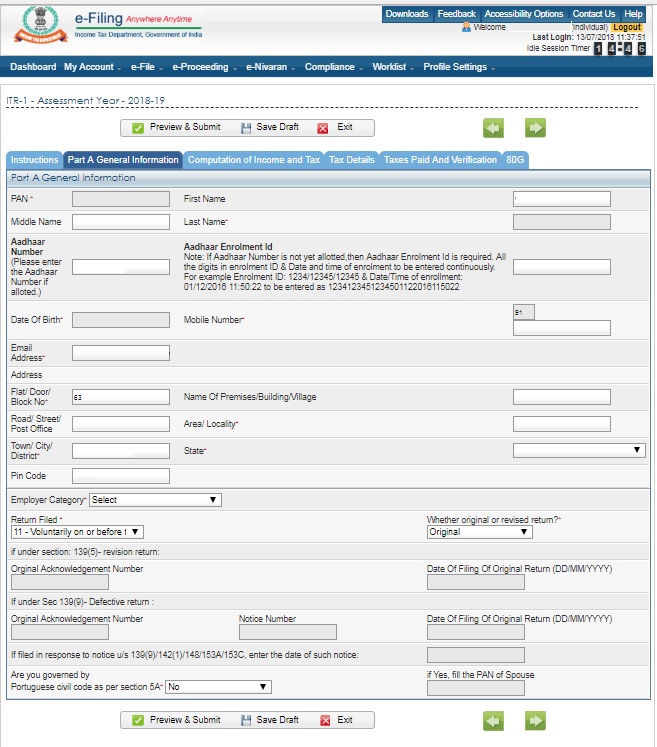

Fill Part A: General Information part of the form

Step 8

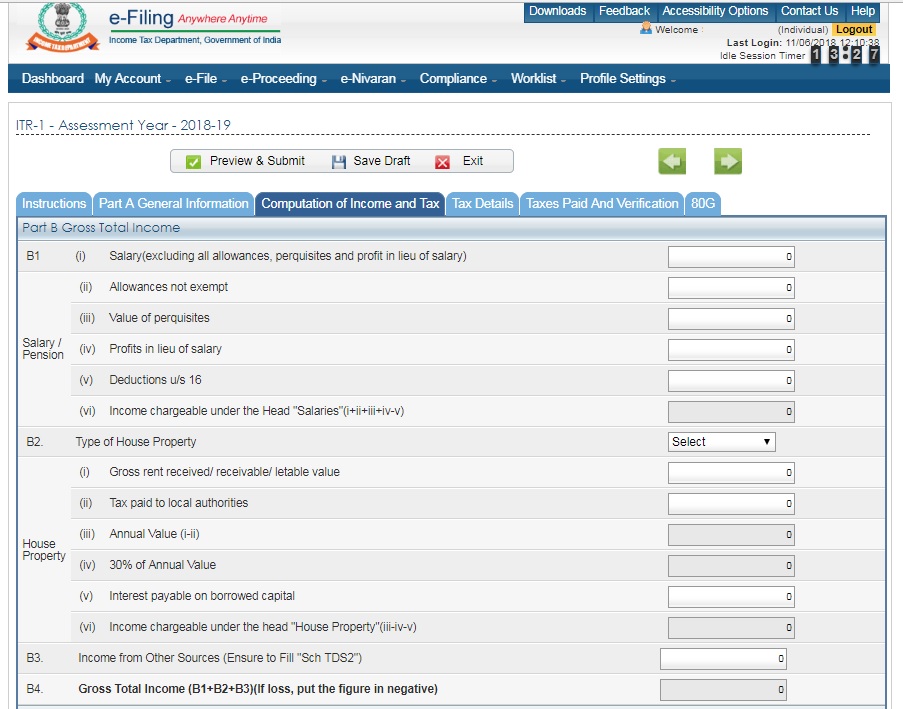

Now fill the details and compute the Income Tax:

Step 9

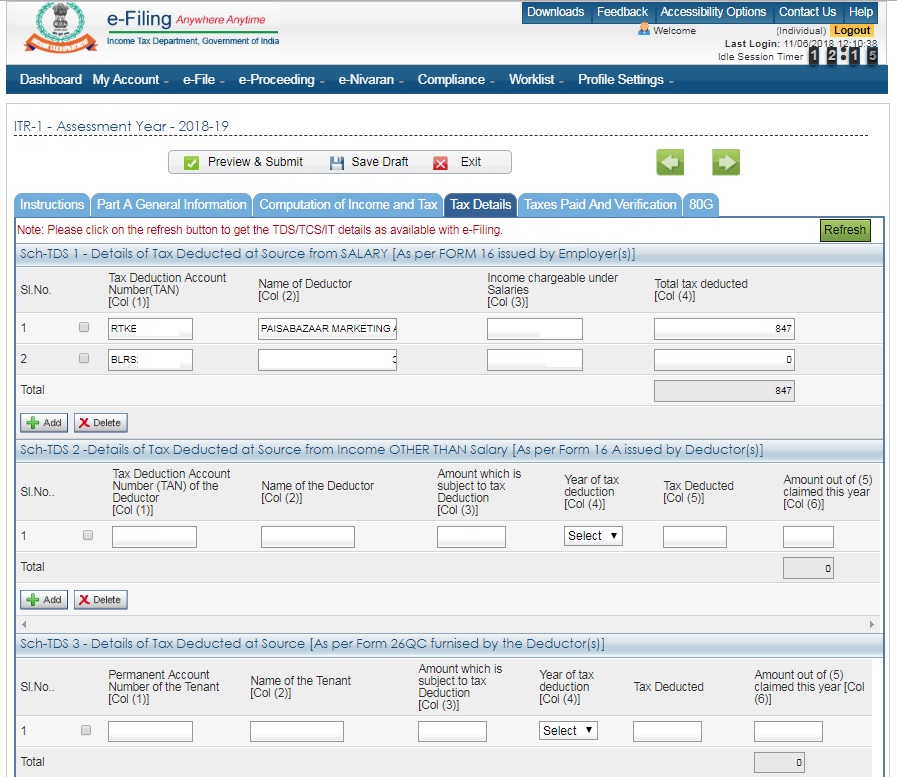

You will be able to see Tax Details. Fill the details not entered previously.

Step 10

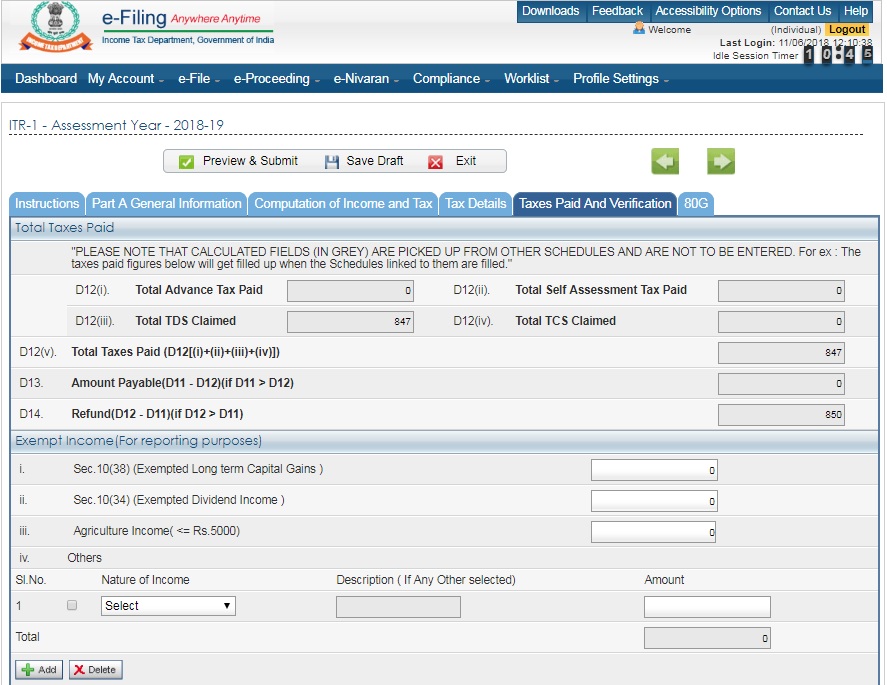

In the “Taxes Paid and Verification” section, your tax details are mentioned.

Step 11

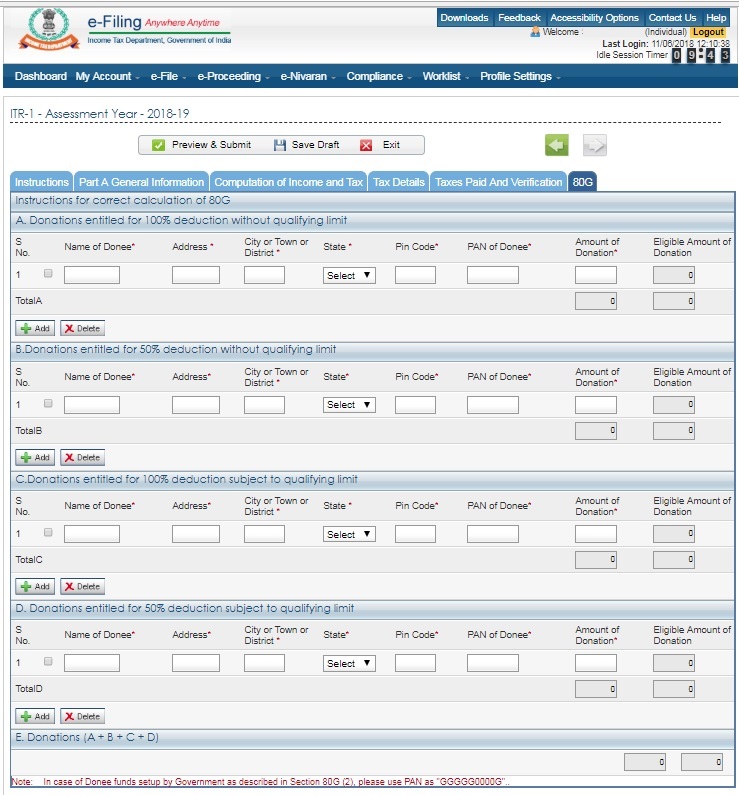

In the “80G” section of the form, mention all deductions under this section.

Step 12

Select the “Preview and Submit” option to preview your ITR e-filing and to run an automated check of any error that might have occurred.

Step 13

Now “Submit” your form and verify using one of the offline or e-verification methods

Step 14

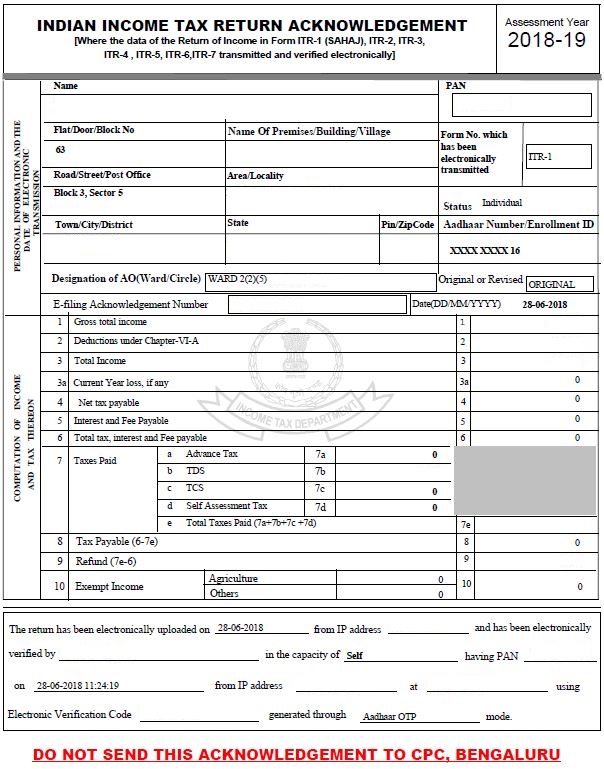

After e-verification is complete, an acknowledgment will be sent to your registered email address by the Income Tax Department. The following is a sample of the IT Department Acknowledgement after e-verification

Eligibility Criteria for Income Tax E-Filing

It is now mandatory under Income Tax rules to complete income tax e-filing. The exceptions to mandatory e-filing by tax assessee are as follows:

In both the above cases, income tax returns can be either e-filed or filed using the applicable paper ITR form.

Documents required for E-Filing of the Income Tax

You do not need to attach any documents with your ITR Form unless required to do so by order of the Income Tax Department.

However, the taxpayer must keep some important documents ready with him/her for a smooth e-filing experience. Some key tax documents for easy income tax e-filing are as follows:

Process to register e-Filing on the Income Tax Department

Visit Income Tax -E Filing Portal

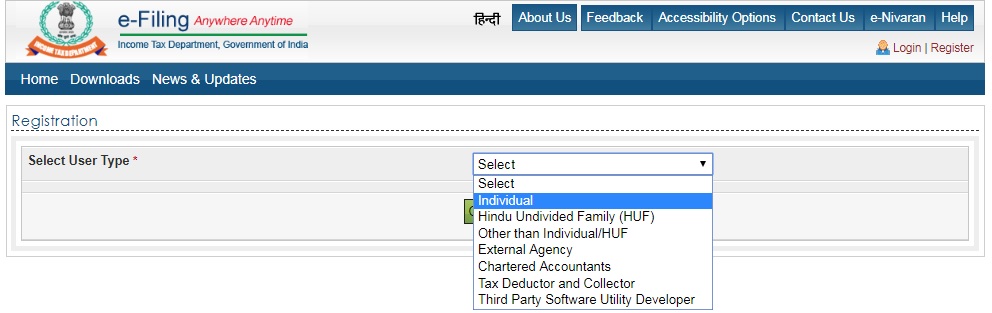

Select the appropriate ‘User type’ – Individual, HUF, Other than HUF/individual, etc.

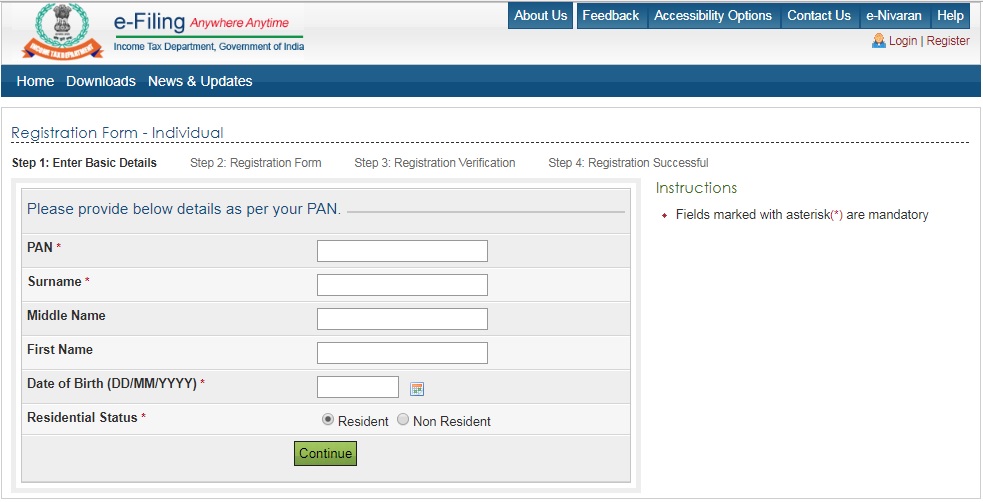

Enter your basic details such as PAN, Name, Residential Status and Date of Birth.

Note:

How to access your account at Income Tax E-filing Login Portal?

After doing registration on the Income Tax E-Filing portal, one can log in to your account

Steps to follow for Income Tax login are as follows:

Advantages of E-filing of Income Tax

E-Filing of income tax returns has been made mandatory by the Government of India. The process is much easier compared to the earlier paper filing process.

The advantages of e-filing of income tax are as follows: