Filing Income Tax return is a method of informing the net taxable income, one is earning from various sources for claiming deductions and net tax liability declaration to the Income Tax Authority. ITR is being filed under the supervision of the Income Tax Department by a salaried or self-employed individual, Hindu undivided family, companies or firms. It can be done by visiting on the e-portal of the Income Tax Department. The process of filing ITR online is referred to as E-filing.

Process to file Income Tax Return online

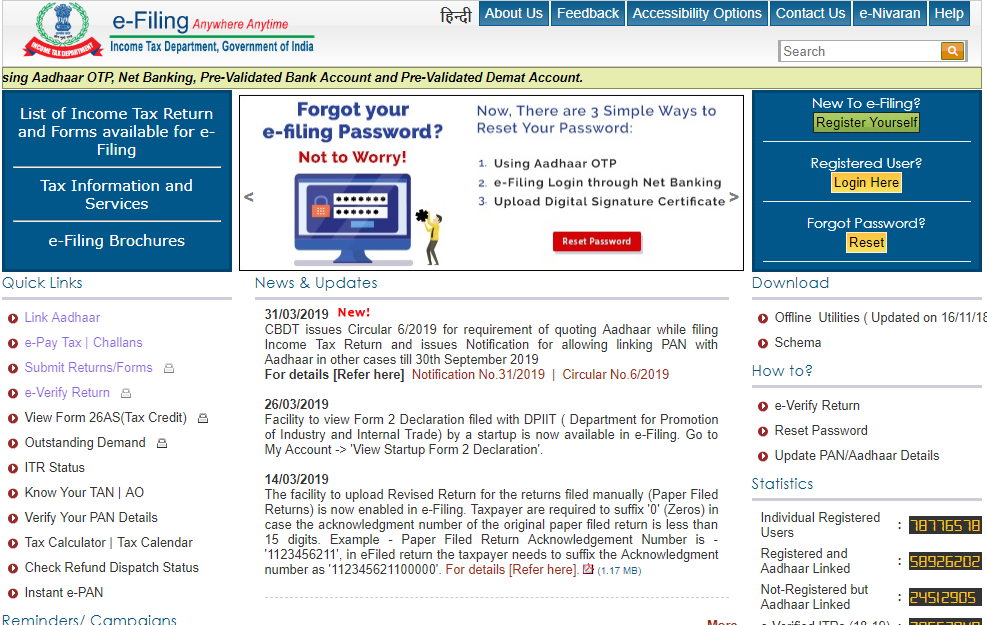

1. Go to E-filing Website

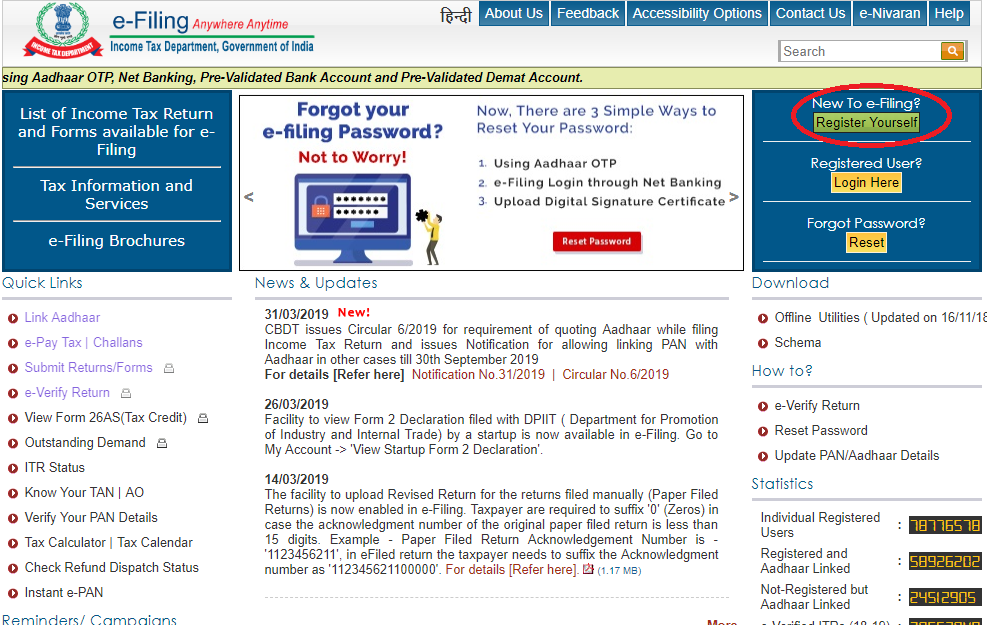

2. If you are new to E-filing, registration needs to be done on the E-Portal.

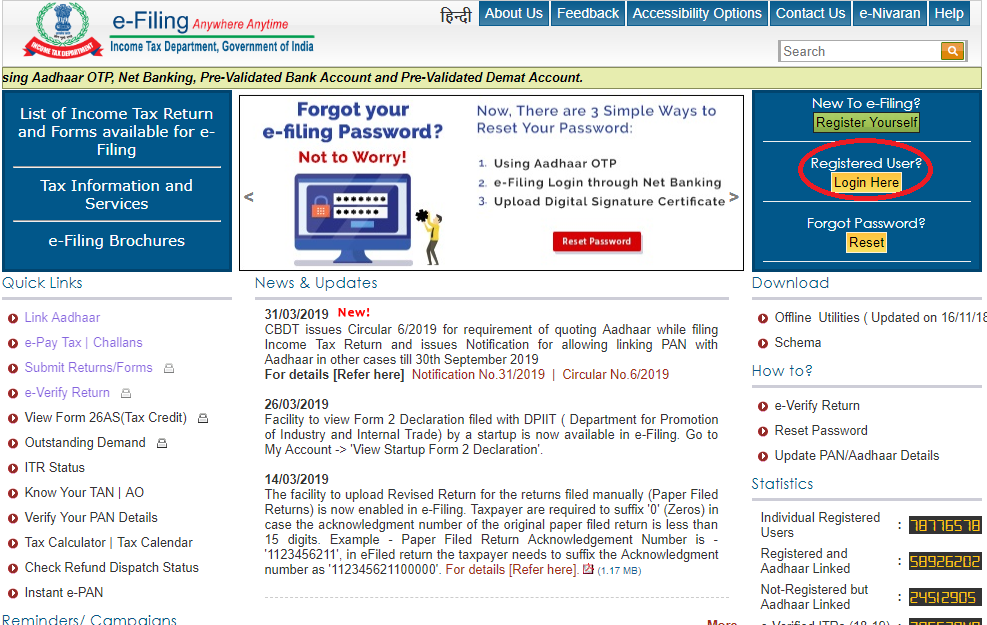

3. If you are already registered, login to your income tax account by providing your User ID (your PAN), Password and Captcha.

4. Select appropriate assessment year, ITR form name as ITR-1 or ITR-4 as per the applicability and submission mode as “Prepare and Submit Online”

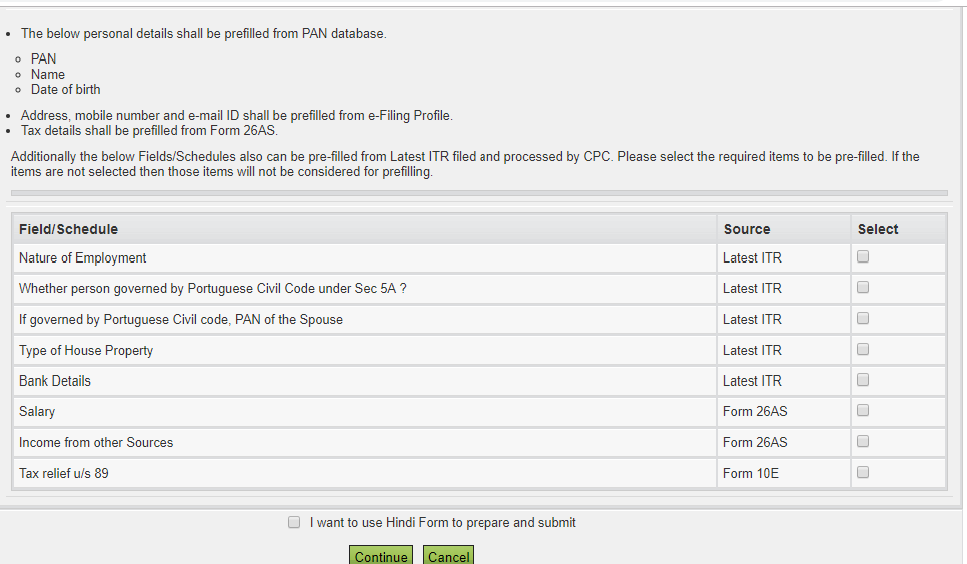

5. If you had filed online ITR before, you can select details which will be automatically prefilled to the selected ITR form. Select those details which you want to be prefilled and click on “Continue”.

6. After filling the above required details, you will be redirected to a page where you must fill the ITR form. One must read all the general instructions given in the start of the form to avoid any mistakes.

7. After reading instructions, start filling ITR form which includes filling of required information such as 'General Information', 'Income Tax Details', 'Tax paid and Verification' and '80 G' in the ITR form.

8. Recheck all the information in the form before making final submission. After getting satisfaction that all details provided in the form is correct, then click 'Preview and Submit 'button. You can preview form before making final submission.

9. After form submission, ITR will be uploaded and option will be given to verify the return using options available:

10. You can verify your return electronically by using Aadhaar OTP or Electronic Verification Code (EVC) method or through an offline method by sending a signed printout of the ITR 5 to CPC, Bengaluru within 120 days from the date of e-filing.

11. Once your return is successfully uploaded, an Acknowledgement or ITR V will be simultaneously sent on your registered email address.

Note: The acknowledgement will also reflect in your account on the e-filing website from where you can download it as and when required.

12. After ITR verification, Income Tax department will start processing and notifies the same via email and sends SMS on your registered mobile number.

13. It is not necessary that an individual can only file for an income tax return from the authorized site of the Government of India but there are also many private sectors that permit filing income tax returns.

14. The private sectors in return of the service rendered charge a fee from the individual. The amount of fee charged varies from firm to firm.

Who is required to file ITR?

Under Section 139(1) of the Income Tax Act 1961, any individual whose total income of the Financial year is more than 2.5 Lakh for Financial year 2020-21 need to file Income Tax return. Apart from that any public or private company based in India or doing business in India, Firms, Association of Persons (AOP), Hindu Undivided Family (HUFs), Body of Individual (BOI) etc. are also liable to declare net profits/losses of the year and pay their tax liability by filing ITR.

Is it mandatory to file ITR online?

Taxpayers belonging to any of the following class are mandatorily required to file their income tax return only through e-filing mode:

Required document for filing ITR

Process to check status of ITR via online

By Acknowledgment Number

By using Log in credentials

Important dates to remember for filing ITR

| CATEGORY OF TAXPAYER | DUE DATE FOR TAX FILING |

|---|---|

| Individuals | 31st August |

| Hindu Undivided Family | 31st August |

| Body of Individuals | 31st August |

| Association of Persons | 31st August |

| Business requiring audits | 30th September |

| Business requiring TP Report | 30th September |

Advantages of filing Income Tax return online

Type of ITR forms

Different forms of ITR are available on the website of the Income Tax Department of India for various types of taxpayers and having total income up to 50 Lakhs.

ITR-1 – This form is also called SAHAJ. ITR-1 or SAHAJ is meant to be filed by an individual whose source of income is from salary, pension, one house property, interest or income from other sources (excluding winning from lottery winnings and income from racehorses) and having the total income of up to Rs. 50 lakhs.

ITR-2 – This form is for individuals or the Hindi Undivided Families (HUFs) who have income which is not from the profits and gains of a business or otherwise profession.

ITR-3 – This form is for different persons or the HUFs whose source of income is from the profits and gains of a business or profession.

ITR-4 – This form is for those who have presumptive income from a business or profession

ITR-5 – This form is for everyone other than individuals, HUF, company and person filing Form ITR-7.

ITR-6 – This form is for all those companies which are not claiming exemption under Section 11 of the Income Tax Act.

ITR-7 – This form is relevant for all people including those enterprises who are required to file tax returns under the Section 139(4A), Section 139(4B), Section 139(4C), Section 139(4D), Section 139 (4E) or 139 (4