Income Tax Refund

Income Tax Refund is a process in which the Income Tax department returns the excess tax paid by the taxpayer at the end of the financial year. It is a case where the actual tax liability is less than the amount paid in the form of tax. As per the provision of Section 237 of the Income Tax Act, 1961, assessee claim tax amount paid in excess. The decision of giving a refund is done by Income Tax Department after doing a thorough verification.

In case, if an assessee fails to furnish investment proofs, in that case, the organization deducts the taxes based on the investment proofs. In such situations, the amount paid in excess by the employee can be claimed back from the government in the form of Income Tax Refund. The Income Tax Department also gives an option to adjust the tax refund against the tax dues as per Section 254 of the IT Act.

Process to claim tax refund

- File your Income Tax Return

- File your income tax return online at the official Income Tax e-Filing website

- You get an acknowledgment number for filing the return online with your digital signature. Apart from that you can also physically sign the ITR- V form generated online and submit the same to Income Tax Processing Centre within a specified timeline that is 120 days of filing return.

- Normally the due date of Income Tax return filing is 31st July each year but also extended sometime by the Income Tax Department.

- Wait till the processing of the refund.

- After filing of Income Tax Return by the taxpayer, the Income Tax Department scrutinizes the claim made and after that process the fund if any.

- All refund claims processing done via State Bank of India.

- The mode of payment of refund is based on details furnished by the Income Tax Return file. Mode of payment uses by the Income-tax department for making refunds are Electronic Clearing system or through cheque or demand draft.

- If you choose to ECS option for crediting of Income Tax refund then it is a must to provide details such as bank account number, bank branch and IFSC code at the time of filing Income Tax Return.

- If you choose a demand draft or cheque as a mode of payment, then it will be sent to your communication address mentioned in the ITR filed.

- Time taken for Income Tax refund is 3-6 months from the date of filing the Income Tax Refund. It may even take a long time if returns are filled physically.

- It’s important to ensure this excess tax paid is reflecting in your Tax credit statement that is form 26AS to get the tax refund.

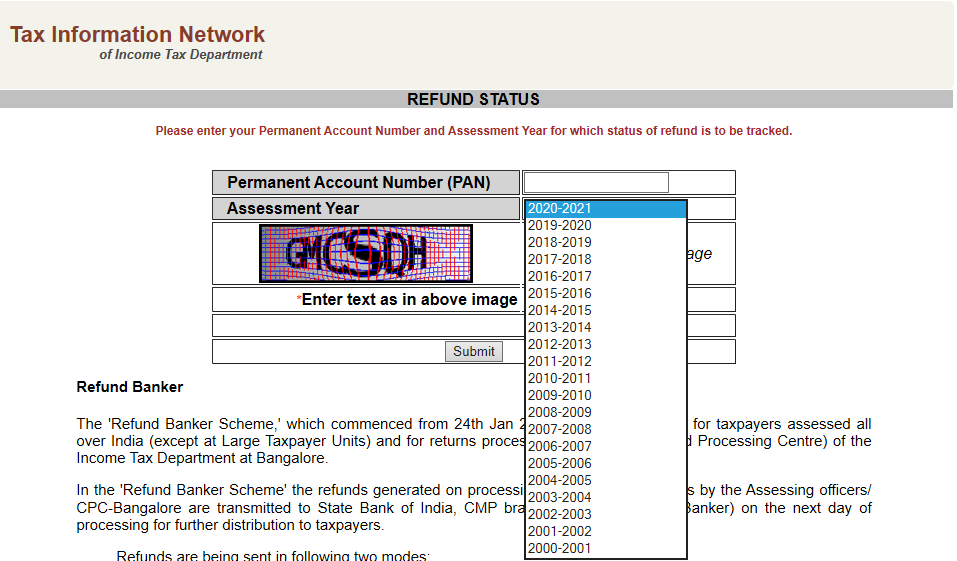

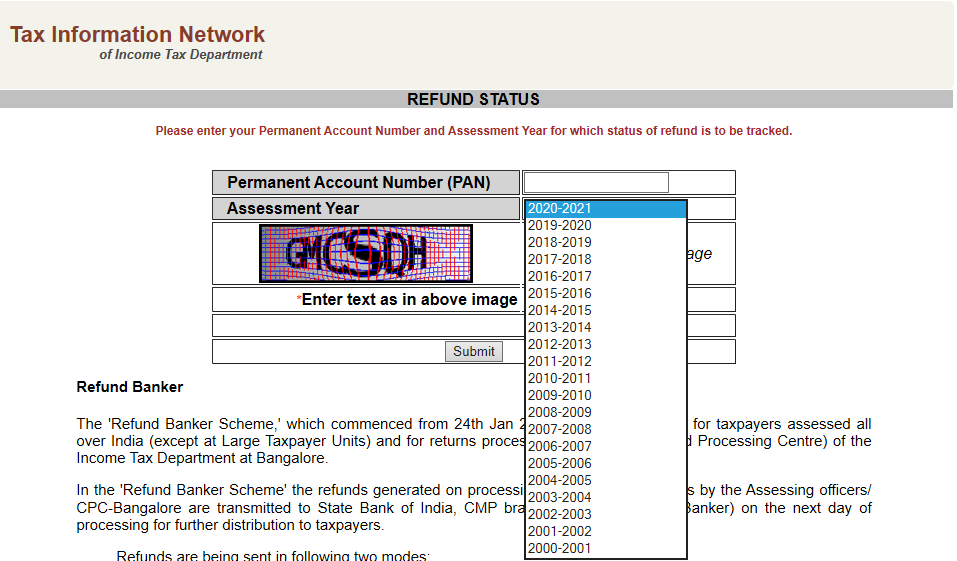

How to check the Income Tax status refund online?

In case, if you do not receive a refund within 06 months, log on to the website of NSDL. Provide all the PAN and other details to check the Income Tax Refund status.

If the status says that ‘Refund had expired’

- Request for issuance of refund by logging into the e-filing portal.

- In case the return was filed physically, then contact your income tax assessing officer.

If the status says that ‘Refund had returned’

- In case of refund made through demand draft or cheque and sent at the communication address which has been returned or undelivered or bank account details provided for ECS are incorrect. In such cases, you need to contact your assessing officer for the issuance of a refund.

- In case of e-filing, place a request for issuance of refund in your e-filing account.

If the status says that ‘Refund paid ‘

- In case of refund made through demand draft or cheque and sent at the communication address which has been returned or undelivered or bank account details provided for ECS are incorrect. In such cases, you need to contact your assessing officer for the issuance of a refund.

- In case of e-filing, place a request for issuance of refund in your e-filing account.

If the status says – ‘no demand no refund’

- In case of refund made through demand draft or cheque and sent at the communication address which has been returned or undelivered or bank account details provided for ECS are incorrect. In such cases, you need to contact your assessing officer for the issuance of a refund.

- In case of e-filing, place a request for issuance of refund in your e-filing account.

Form 30 is a refund request form which needs to be submitted to the Income Tax Department. It mentions the amount paid which is more than the actual tax liability for an assessment year. Along with the form 30, the taxpayer also needs to enclose investment proofs and other documents as the justification of refund claim.

What are the eligibility criteria for Income Tax Refund?

- If the tax paid based on self-assessment is more than what you are liable to pay.

- If TDS is deducted by the employer or by the bank is more than liability as per the regular assessment.

- If the tax liability for the financial year is Rs 25000 and TDS deducted by the employer is 30,000. You can claim a refund of Rs 5000, for the extra amount of tax deduction taken place.

- When you are not able to provide details of tax-saving investments in a stipulated period, then one can claim the tax refund after providing proof to the Income Tax Department at the end of the financial year.

Double Taxation

India has double taxation avoidance agreement with few countries, for instance, if you are a non- resident Indian working in a Foreign country with which India has a double taxation agreement, in that case, you hold a Non-resident ordinary deposit in an Indian bank and interest comes on before-mentioned fixed deposits shall be taxed as per the applicable slab rate.

Banks deduct the tax at source before crediting the interest into your account. Now, if you qualify to be tax resident of the foreign country where you reside, you may claim for refund of TDS deducted on interests earned in India on your NRO deposit.

Time limit for claiming of Income Tax

One makes sure to claim for tax refund within a year from the last date of assessment year. In some special cases only Assessing Officer can consider the refund claims even after the prescribed time limit is over.

Following terms and conditions are to be kept in mind:

- In case, there is a delay in scrutiny of refund that needs to be reconsidered by the Assessing Officer.

- No interest will be allowed to pay on refund of belated claims

- No income tax refund claims are to be entertained after the completion of 6 consecutive assessment years.

- The refund amount should not exceed Rs.50 lakh or more for one assessment year.

Special cases of Income Tax Refund

Under Section 238 of the Income Tax Act, 1961, if a person or his legal representative is unable to claim tax refund due to various reasons such as death, insolvency, incapacity, liquidation or due to any other cause, he/she is entitled to claim such refund for the benefit of such person or his estate.

As per the provision of Section 238 of the Income Tax Act, 1961, if any person’s income is clubbed with the income of another person, in such cases, only the latter alone is entitled to receive Income Tax Refund for such income.

Income Tax Refund on Appeal

Under Section 238 of the Income Tax Act, 1961, if a person or his legal representative is unable to claim tax refund due to various reasons such as death, insolvency, incapacity, liquidation or due to any other cause, he/she is entitled to claim such refund for the benefit of such person or his estate.

As per the provision of Section 238 of the Income Tax Act, 1961, if any person’s income is clubbed with the income of another person, in such cases, only the latter alone is entitled to receive Income Tax Refund for such income.

Interest on Delayed Income Tax Refund

- Under the provisions of Section 244A of the Income Tax Act, 1961, if there is any delay in payment of refund, the interest at the rate of 6% p.a. will be payable by the Income Tax Department

- Interest on refund amount is calculated from the date of payment of tax to the date of actual payment of the refund

- For instance, if a person claims for a refund of ₹ 5,000 for the assessment year 2017-2018 and the refund was paid to you on March 2018, the interest on the refund will be calculated from April 2017 to March 2018

- It is important to note that the interest is payable only if the amount of tax refund due is more than 10% of the tax payable by you

- The interest amount for the period attributable to the part of the assessee will not be paid by the Income Tax Department if the delay is found to be from the side of assesses

Adjusting Income Tax Refund against outstanding dues

As per the provision of Section 245 of the Income Tax Act, 1961, Assessing officers given power to set-off or adjust income tax refunds which are being claimed against the tax dues that are outstanding from the side of the taxpayer or assesses.

The Income Tax Department sends an intimation under Section 245 on the receipt of the refund request received from the side of the taxpayer. The intimation will be about refund due that can be set off against a tax due.

Tax Treatment of the Income Tax Refund

- A Refund is just an excess tax being paid is not treated as income. Make sure that tax refunds are not part of taxable income

- If you have received any interest on the delayed refund payment, then interest portion of the refund amount is treated as income for the assessee

- This income is taxable as per the applicable income tax slab rate of the respective assessee

Income Tax Refund Helpline

The process of claiming an income tax refund can sometimes be tricky. To make the process easier for taxpayers, the Income Tax Department offers its customer care service. Taxpayers can avail of the service for queries or issues regarding the income tax refund, re-issue, and rectification. Here are some important details related to income tax refund helpline:

Contact Numbers: 18001034455 (Toll-free)/+91-80-46605200

Working Days: Monday to Friday

Working Hours: 10:00 A.M. to 08.00 P.M.

Important Points about Income Tax Refund

- A small error in e-filing could land you up in the trouble of denial of tax refunds or delayed refunds. Here are some of the important points to be noted

- If you want that there should be speedy processing of Income Tax Refund, do the E-filing of your returns before the due date

- Make sure that the correct tax form should be chosen for filing your income tax return to avoid delays and denial of the tax refund.

- Ensure your details filled should be the same in Form 16 matches with the details of the tax credit statement Form 26AS.

- The Income Tax Department refers to the tax credit statement Form 26AS for scrutiny.

- If details are not correctly reflected in Tax Credit Statement Form 26AS, the Income Tax Department may deny your claim of a tax refund.

- The mismatch could be due to the wrong entry of PAN details by your employer or bank etc.

- Due to the non-deposit of TDS to the government by the deductor. So, it is essential to take the right measures to avoid any delay of refund.

- Ensure to mention the details correctly. It gets difficult to get a refund when the wrong bank account number is quoted.

- Currently, the Income Tax Department credits the refund amount directly to the bank account of the taxpayer.

- The Income-tax department gives the facility to check the income tax refund status online with your e-filing login.

- A timely review of status can help the taxpayer to take corrective measures. The Income Tax Department refunds the amount if it finds authenticity in your request after scrutinizing all the documents and facts.