Income Tax Return Form 1

All the individuals to file Income Tax whose income is above Rs 2.5 Lakhs (in case those below the age of 60 years) and Rs 3 lakh in case who are above 60 years old but less than 80 years. Those who are above 80 years old, limit set for them is Rs 5 Lakhs. These exemption limits keep on changing from time to time, depending on the government policies and notifications.

The procedure to file Income Tax returns is quite simple. One just needs to be aware of different kinds of ITR forms based on their applicability.

ITR 1

Form ITR 1 or ‘SAHAJ’ is the most common form for filing Income Tax Returns. It is primarily used by the salaried individuals who need to make return submissions through ITR form 1 or ITR-2A.

Taxpayers Eligible to use Form ITR-1

Form ITR-1 can be used by individuals belongs to the following categories:

- Any salary or pension earned by an individual from his/her employer and taxable under the category “Income from Salary”.

- Income earned from house property.

- Income earned from other sources like interest income, dividends earned, etc.

- If the income of the taxpayer has been merged with the income of a minor or a spouse, in that case, the additional income should also adhere to the previously mentioned clauses, for the taxpayer to use Form ITR-1.

Taxpayers who are not eligible for ITR1

- Income earned from lottery or winning from horse races or legal gambling.

- Income earned from multiple house properties. Also, any loss under “Income from House Property’’ if it was carried forward from the previous financial year.

- Income from capital gains that are taxable which can be both long-term as well as short-term capital gains.

- Person whose agricultural income is more than Rs 5000.

- Income earned from professional fees or income earned through business.

- Loss under the head “Other Sources”.

- Individuals applying for relief under DTAA from double taxation or foreign tax that has been paid as per provisions of Section 90, Section 90A or Section 91.

Any resident individual having an asset not located within the country or one who acts as a signing authority for accounts located out of the country. The term asset, for this purpose, includes financial interest, such as shares or bonds, in any entity.

The process to download Form ITR 1

Step 1

Visit the official website of Income Tax https://www.incometax.gov.in/iec/foportal/

Step 2

Click “Offline Utilities” under Download section

Step 3

Click “Income Tax Return Preparation Utilities”

Step 4

Choose your Assessment Year

Step 5

Click “Excel Utility” for filling the details by hand under the ITR 1 column and download the file

Step 6

Extract the downloaded file and fill in the details

Penalty on late filing of ITR

In case the taxpayer fails to file Income Tax Return, then there is an option of “Belated Return’’ available before 31st March. Late filing of return also attracts a penalty. In case, return filed before 31st December, penalty charged is Rs 5000 and in case return filed after 31st December, penalty charged would be Rs 10,000. However, in case the income is less than Rs 5 lakh, the maximum amount to be paid would be Rs 1,000 as a penalty.

Structure of ITR Form 1

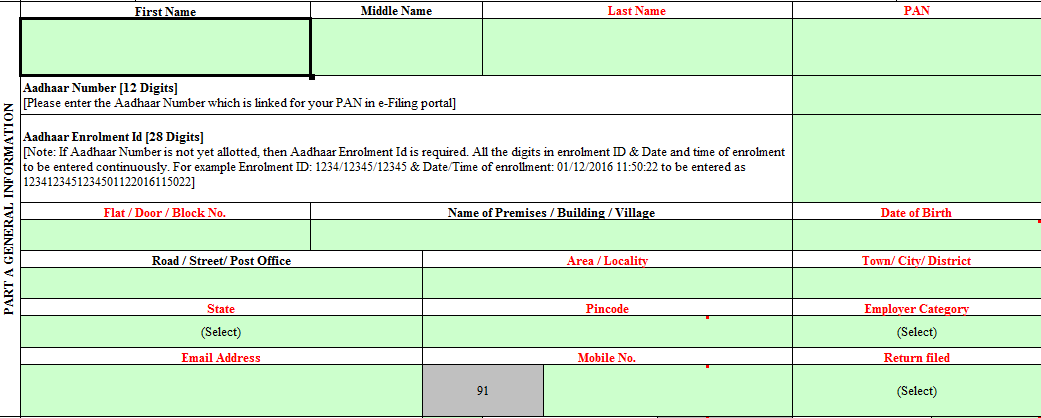

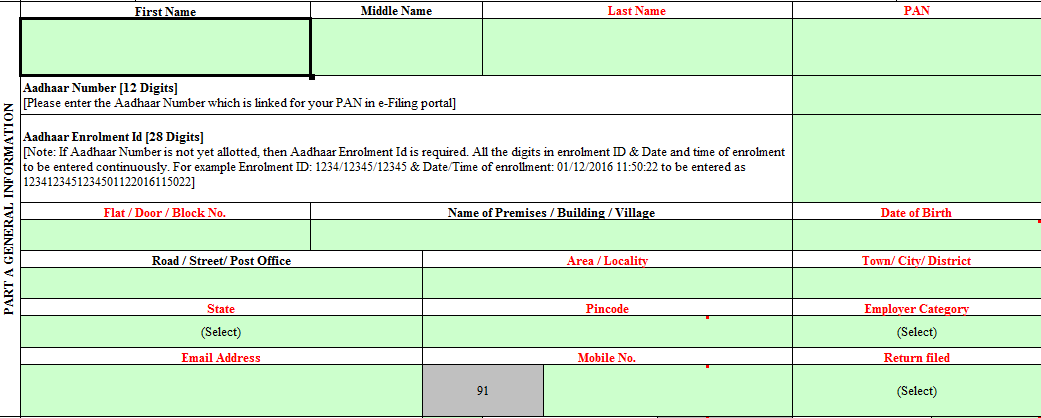

Part A

Personal and identifiable details of the taxpayer, such as name, PAN number, and address.

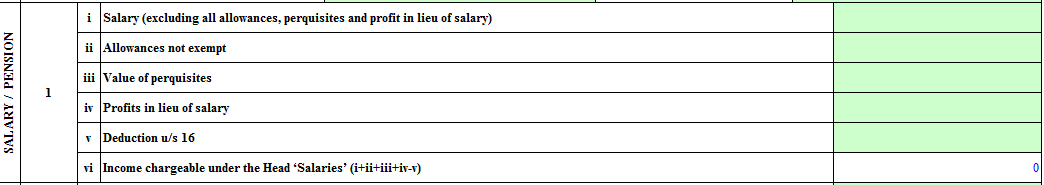

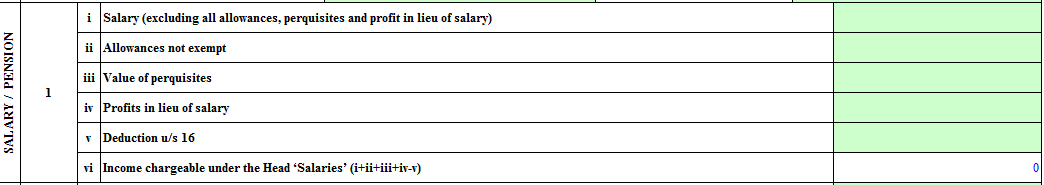

Part B

Total income of the financial year

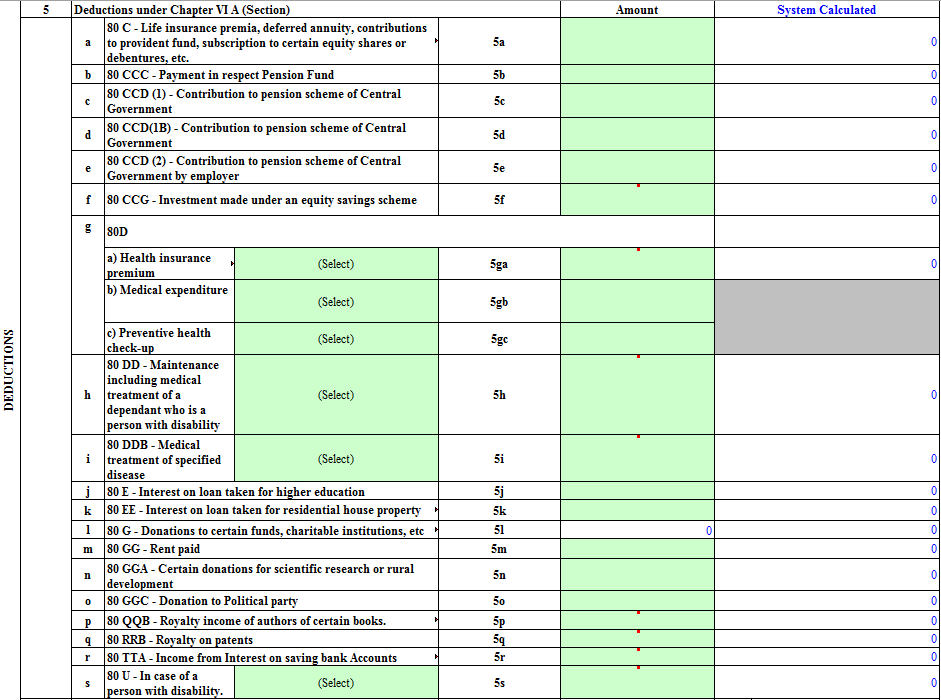

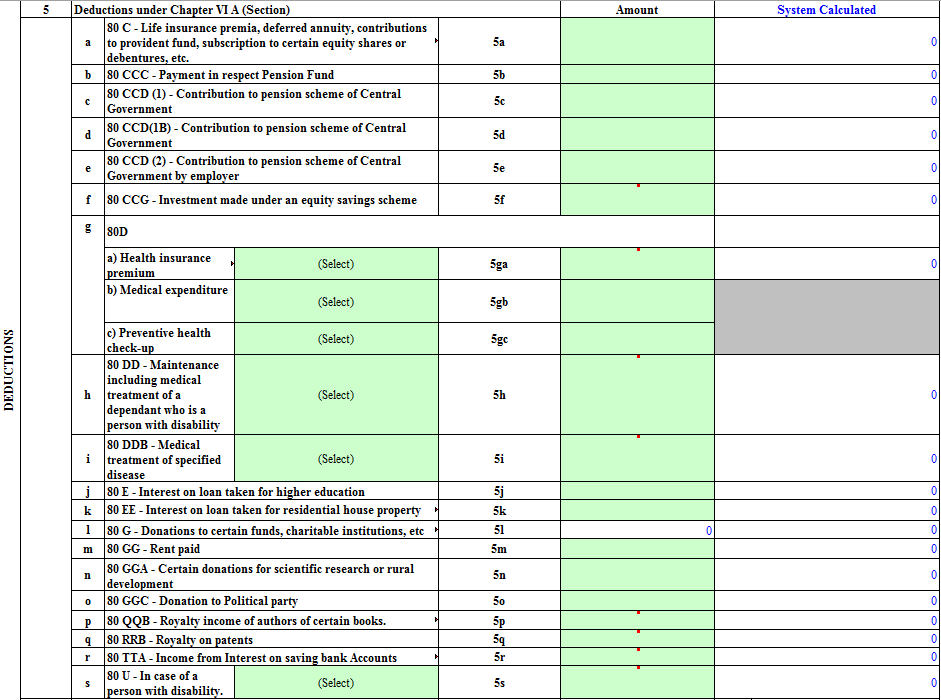

Part C

Details of all deductions and total taxable income

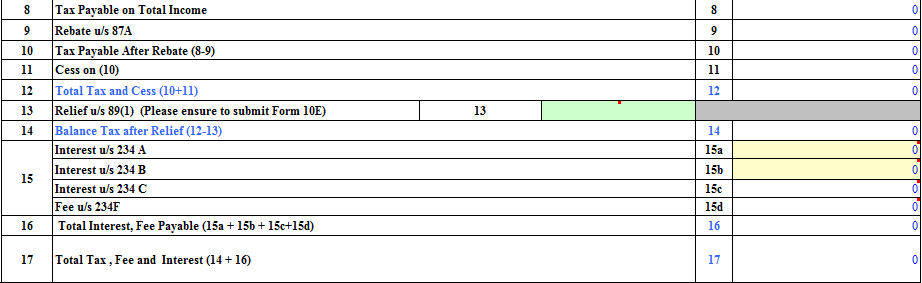

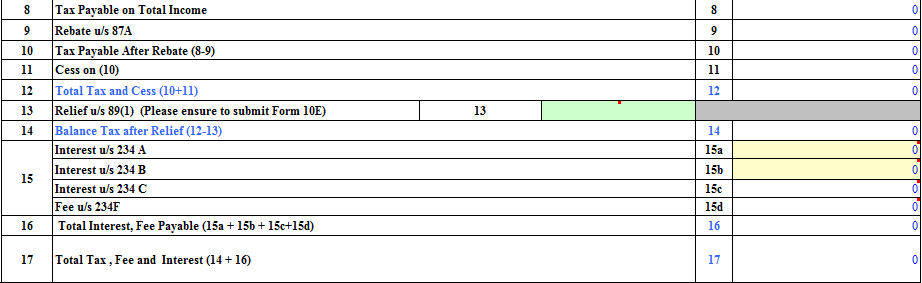

Part D

Details of Tax calculation and status

Schedule IT: Information regarding payments made towards Advance tax and Self- Assessment Tax Paid.

Schedule TDS1: It gives information regarding TDS deducted from salary and as mentioned in Form 16 provided by the employer.

Schedule TDS2: It gives Information regarding TDS deducted from “Income other than salary” and as mentioned in Form 16A provided by the deductor.

Supplementary schedules of tax deducted at source and Income Tax which are to be used after exhausting the line items in the main portion of the form.

Methods of submitting the ITR Form 1

There are two ways of making submission of submitting the Income Tax Returns which are mentioned below:

Offline

- By furnishing ITR in the physical or paper form

- By furnishing ITR in a bar-coded return form

Online

- Filing returns electronically with a digital signature.

- By submitting the data in the return form electronically and after that submitting the signed copy of the Return Form ITR-V.

- The Post-financial year 2013-14, taxpayers with annual income above Rs. 5 lakhs are required to furnish their income tax returns in an electronic format i.e. the online mode as mentioned above.

Procedure for completing Form ITR-1 Offline

- An assessee whose annual income is less than Rs 5 lakh are liable to file an ITR offline.

- One can collect the form from the Income Tax Office or download the same from the website incometaxindia.gov.in.

- In the case of offline, ITR form needs to be submitted to the Assessing Officer of designated helpdesks known as “Aayakar Sampark Kendra”.

- Along with the filing of Income Tax return, a person also needs to fill the acknowledgment form which is the summary of the ITR.

- A stamped copy of the acknowledgment form is given back to the assessee after the submission.

Procedure for completing the ITR-1 Form online

- Taxpayers need to sign in on the website of the Income Tax Department.

- It is a one-time sign in after that account created on the website of Income Tax can be used for subsequent years.

- In addition to the regular excel utility, the I-T Department has introduced a new Java-based utility that has many new features, including direct upload, smoother interface, etc.

- Taxpayers can choose to submit the details by either using excel/java utility or without it.

How to use Excel Java Utility ?

- Log in to the account on the website https://incometaxindiaefiling.gov.in/.

- Post that, download ITR Java or Excel Utility and give all the required details. It is essential to do verification of details mentioned in Form 16, Form 16A or Form 16B as per the applicability, and Form 26AS.

- After verification, the taxpayer login to the website of the Income Tax and directly upload the return through the Java Utility. The taxpayer can create an XML version of the return form and upload the same on the website.

- Post successful submission and upload, an Acknowledgement message would appear on the screen. The ITR-V also gets generated which is to be e-mailed by the taxpayer to the I-T Department’s email mentioned on the form.

When you are not using Excel or Java Utility?

Filing of ITR can be done online even without downloading the Excel/Java Utility software;

- Log in to the account on the website https://incometaxindiaefiling.gov.in/.

-

Go to "E-File – Income Tax Return- Prepare and submit online".

- The taxpayer would need to furnish all the required details.

If the taxpayer does not make use of "Digital Signature" at the time of filing ITR, then, in that case, ITR Form-V sent to the taxpayer on his or her registered email address. This ITR-V needs to be signed by the taxpayer and sent back to the Income Tax Department within 120 days after filing of Income Tax Return.

From the Financial Year 2014-15, the government also provided an option to link ITR form with the taxpayer’s Aadhar Card. Once linked, there is no need to send ITR-V copy to the officials. As of the assessment year 2017-2018, it is mandatory to link Aadhaar with PAN.

Acknowledgment

Taxpayers who submitted their returns via electronic or online mode, in that case, acknowledgment copy is mailed by the Income Tax Department on their registered email address. One also has the option of downloading the acknowledgment copy from the Income Tax Website. Taxpayers who use the physical form to submit their returns receive their acknowledgment copy from the I-T Department after the submission of the form.

Documents needed to file Form ITR 1

A smart taxpayer should keep the following documents handy while filling the ITR-1 Form. This will not only simplify the process but also expedite it.

- Form 16 In case the taxpayer was working with multiple employers in the previous year, then he or she needs to keep a record of all the Form16 received from those employers.

- Form 16A: If the taxpayer received any form of interest income or pension from banks or other institutions, the taxpayer would have been given a certificate or Form16A. It proves to be an essential document at the time of filing a return.

- Form 26AS: In case the taxpayer was working with multiple employers in the previous year, then he or she needs to keep a record of all the Form16 received from those employers.

- Bank Statements or Passbooks: It is required to check and provide complete details of the interest received on saving account and time deposits (Fixed Deposits or Recurring Deposits). The total interest amount reflected under the head “Income from other sources’’ irrespective of the TDS.

- Supporting documents for exemptions or investments: If any investment made by the taxpayer post the submission of proofs to the employer, but at the end of the financial year, the taxpayer not able to provide proof or certain deductions or exemptions on time which includes HRA allowance or Section 80C or 80D deductions.

- PAN card

Benefits of using an online mode to file an ITR

Following are some of the other benefits:

- Software fills automatically all the information such as personal details, contact details, and address. It becomes possible because of the previous year data stored in ITR against the PAN in the Income Tax return against the PAN in the IT Department.

- The system in the software prevents the form from getting submitted and prompts the taxpayer about the missing information in the mandatory fields.

- Calculates tax payable or refunds, basis the income and deductions filled in ITR, reducing the chance of incorrect calculations.