Income Tax Login

To complete the E-filing of the Income Tax Returns, you are required to complete the registration on the home page of Income Tax e- filing. After completion of the Income Tax log in process, one can access the e-filing portal and access a range of tax-related services.

How to do Income Tax Website log in?

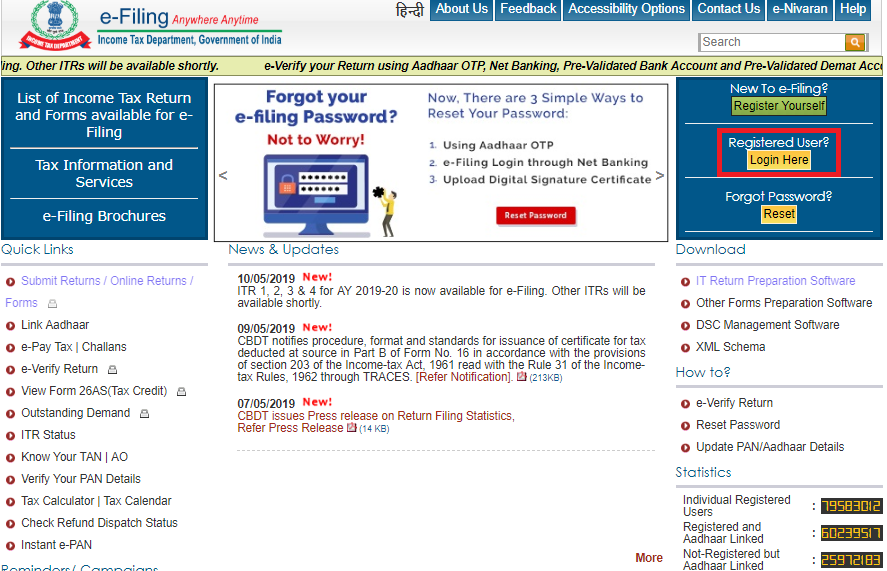

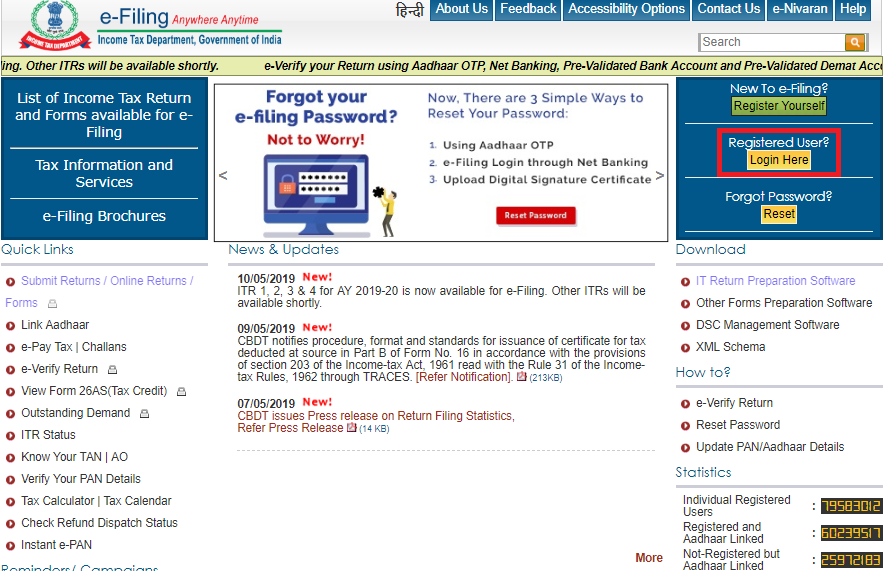

Step 1: Go to the Income Tax e-filing website and click on the “Login Here” link located at the right-hand top corner of the page as shown below:

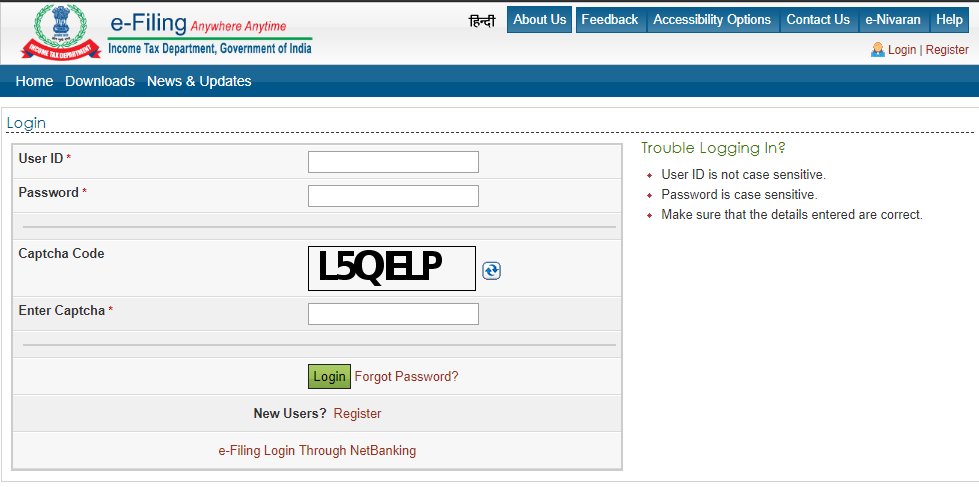

Step 2: Once you have clicked on the “Login Here” button, you will be redirected to the Income Tax Login page as shown below:

Step 3: On the login page, you must provide your User ID i.e. PAN (Permanent Account Number) and the password you have set for your income tax e-filing account at the time of registration.

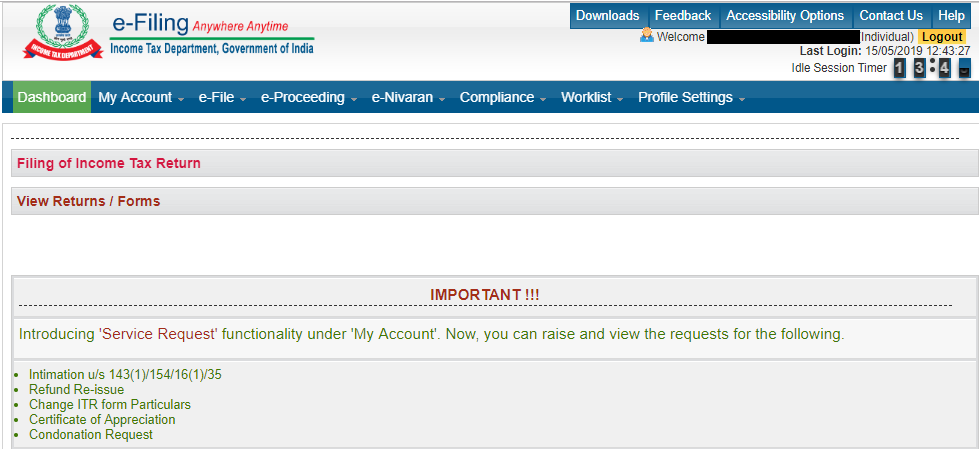

Step 4: Once you have provided these details along with the captcha code, click on “Login” to complete the income tax login of you e-filing account. After login, the income tax e-filing account dashboard view is as follows:

Process of Income Tax login via Internet Banking

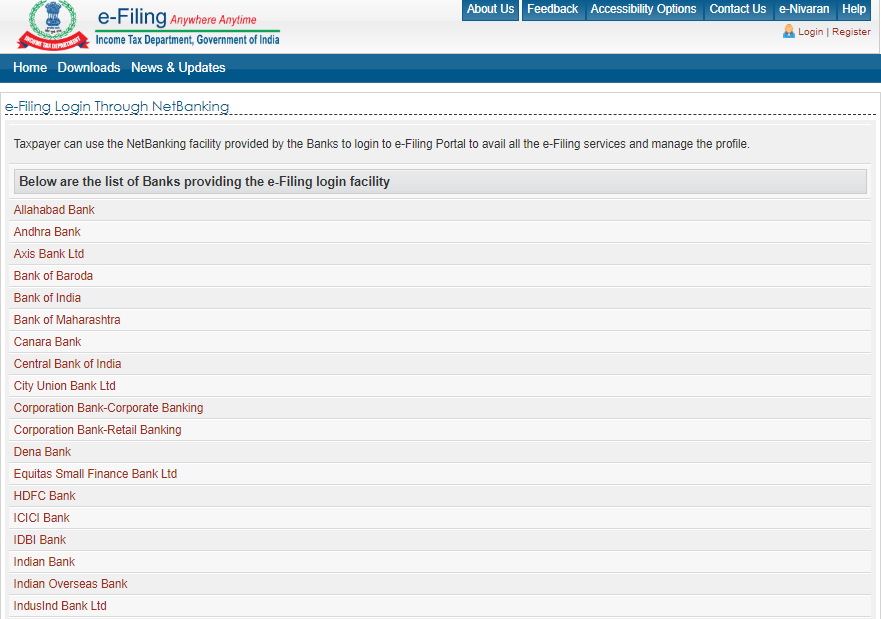

E-portal of Income Tax allows individual tax assessee to log on to the e-filing portal through interface of internet banking of major banks in India. Currently, this facility is only available to those who have updated their PAN details with their respective banks.

Step 1: Go to the e-filing portal through Internet banking page. This page contains a complete list of the banks that offer income tax login through their Internet banking portal.

Step 2: Click on the applicable bank name to get redirected to the Internet banking login page of your chosen bank.

Step 3: With the help of your Net banking ID and password, log in to the banking portal and access a range of services available after completing log in on the e-filing portal. One must make sure that for Net banking PAN details should be uploaded.

How to reset Income Tax E-filing login password?

You can reset or recover your Income tax e-filing account password in case you have forgotten it. The following are the key steps of the process:

Step 1: Go to the home page of the Income Tax e-filing website and click on the “Reset” button located at the top right-hand corner of the page.

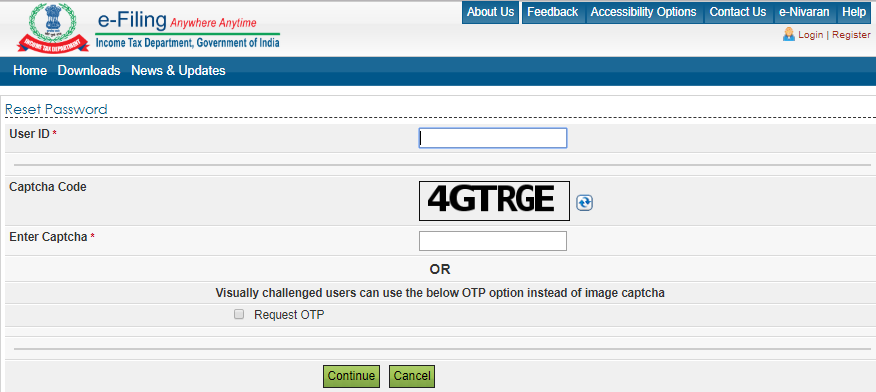

Step 2: On the subsequent page, you must provide your income tax e-filing portal User ID which is your PAN. After providing the captcha code on this page, click “Continue” to start the income tax login password reset process.

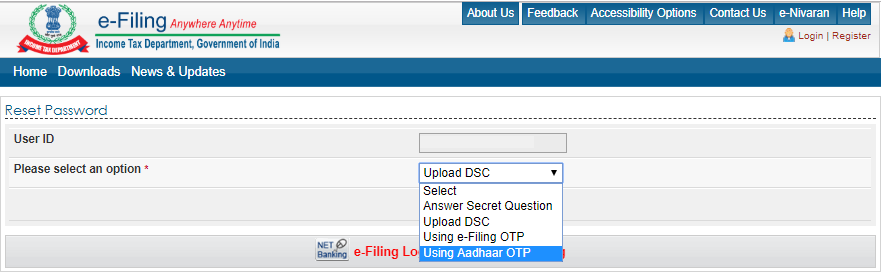

Step 3: At the time of resetting your income tax e-filing ID password using any of the 4 available options:

Answer secret question (as set at the time of Income Tax e-filing portal registration)

Step 4: Provide applicable OTP or upload applicable file and input new password for completing the process of resetting of income tax login password.

Key Services Available after Income Tax e-Filing Portal Login