‘TDS Challan’ shall be used for depositing TDS with the government. One can make use of single challan under various sections of the Income Tax Act. If the government wants or assessee is willing to make TDS payment without using a challan, in that case, the due date of depositing TDS shall be the same day on which TDS was collected.

Different types of TDS Challan

TDS challan 281

TDS challan is used either for making TDS deposits or Tax Collected at Source by the corporates as well as Non- Corporate entities. Any TDS or TCS collected by the seller from the buyer at the time of sale of specific goods also needs to fill the TDS Challan. Taxpayer can do filing of TDS challan 281 online or offline. Challan Identification Number (CIN) is issued when the payment is done online or through some mode offered by the bank.

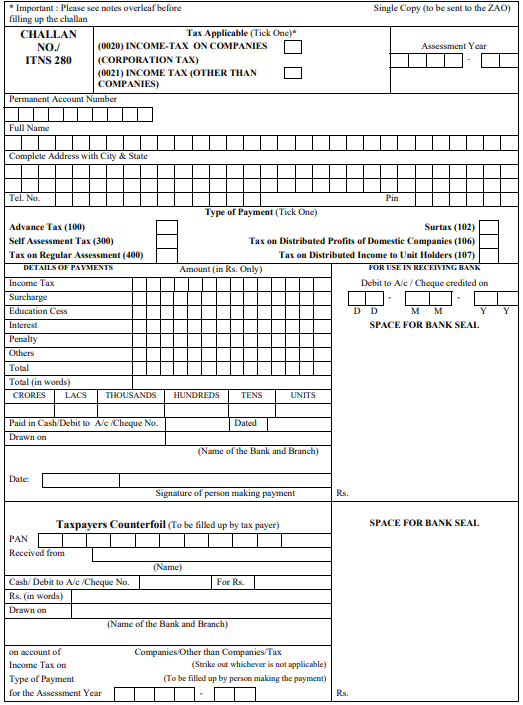

TDS Challan 280

TDS challan is used either for making TDS deposits or Tax Collected at Source by the corporates as well as Non- Corporate entities. Any TDS or TCS collected by the seller from the buyer at the time of sale of specific goods also needs to fill the TDS Challan. Taxpayer can do filing of TDS challan 281 online or offline. Challan Identification Number (CIN) is issued when the payment is done online or through some mode offered by the bank.