EPF Claim

Status: How to Check Your EPF Withdrawal Status Online

The Employees’

Provident Fund (EPF) is one of the most trusted retirement savings schemes

in India, managed by the Employees’ Provident Fund Organisation (EPFO).

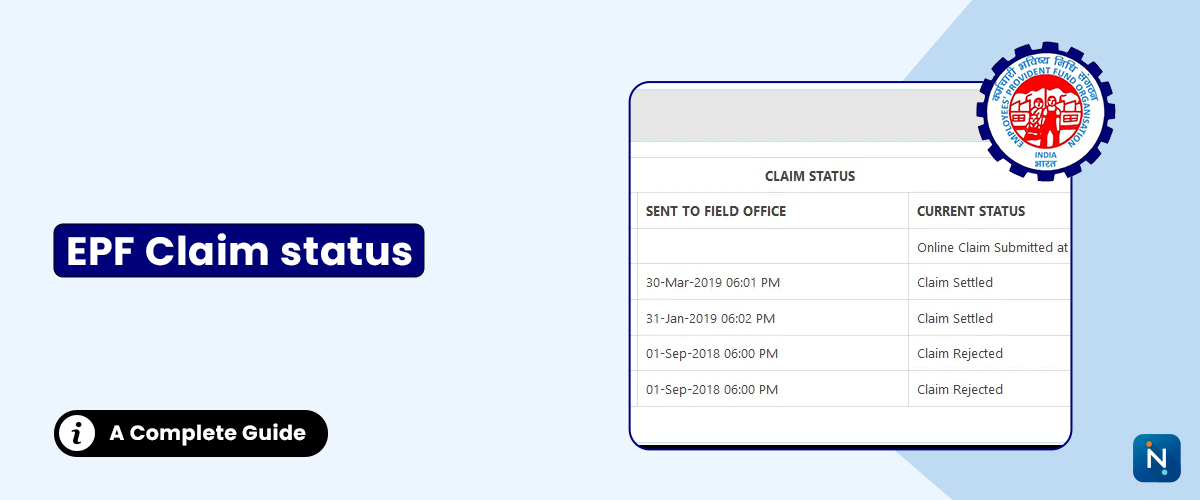

If you have applied for an EPF withdrawal, knowing your EPF claim status

can help you track your application and ensure timely processing.

In this

guide by IndiaLends, we’ll walk you through simple steps to check your

EPF claim status online, important timelines, and common issues that may delay

your claim.

What is

EPF Claim Status?

EPF claim

status tells you whether your PF withdrawal, pension withdrawal, or transfer

request has been accepted, rejected, or is still under process. This

feature is useful for:

Ways to

Check Your EPF Claim Status Online

Here’s a matrix-driven

view of the different methods to track your claim:

|

Method |

Requirements |

Steps

to Check Status |

Processing

Time |

|

UMANG

App |

Aadhaar-linked

UAN, Registered mobile |

1.

Download UMANG App |

Instant |

|

EPFO

Member Portal |

UAN,

Password, Captcha |

1. Visit EPFO Member Portal |

Instant |

|

Missed

Call Service |

Registered

mobile number |

1. Give a

missed call to 011-22901406 |

Few

seconds |

|

SMS

Service |

Registered

mobile, UAN |

1. Send

SMS “EPFOHO UAN ENG” to 7738299899 |

Few

seconds |

Step-by-Step

Guide to Check EPF Claim Status on EPFO Portal

1.

Visit the

official EPFO Member Passbook Portal.

2.

Log in with

your UAN and password.

3.

Click

on ‘Track Claim Status’ under the services tab.

4.

View

the current status of your claim request.

How Long

Does EPF Claim Processing Take?

Common

Reasons for EPF Claim Delay

Tips to

Avoid EPF Claim Rejection

Why Track

Your EPF Claim with IndiaLends?

At IndiaLends,

we aim to make financial processes easier for you. While you track your EPF

claim status, you can also explore instant personal loan offers with quick approval and minimal

documentation. This can help if you need funds before your EPF claim is

processed.

Frequently

Asked Questions (FAQs)

Q1. Can I

check my EPF claim status without UAN?

No, UAN is mandatory for checking EPF claim status online.

Q2. How

many days does it take to get PF after claim approval?

Usually, it takes 3–5 working days for the amount to be credited after

approval.

Q3. Can I

track my EPF claim through SMS?

Yes, send an SMS “EPFOHO UAN ENG” to 7738299899 from your registered mobile

number.

Q4. What

should I do if my claim is showing as ‘Rejected’?

Check the rejection reason on the EPFO portal and reapply after correcting the

error.

Q5. Can

IndiaLends help me with EPF-related services?

While IndiaLends does not process EPF claims, we provide financial solutions

like personal loans to help you meet urgent financial needs.