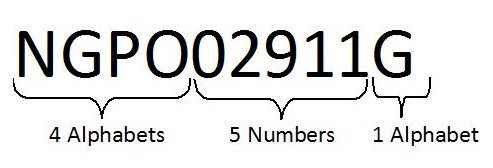

Tax deduction and Collect Account number is the full form of TAN. It is a 10-digit alphanumeric number. It is required at the time of filing TDS returns under Section 203 A of the Income Tax Act, 1961. TAN is required by all those individuals who were responsible for deducting and collecting taxes.

Under the provision of Sector 203A of the Income Tax Act, 1961, it is a mandate for each of the TAX deductor to mention the TAN number in the below documents

TAN is required for quoting while filing TDS/TCS/ Annual Information Returns, certificates and Payment Challans. In such cases, if 10 Digit number is not quoted, then return files would not be accepted by TIN Facilitation Center and even banks will also not accept the challans for TDS and TCS payments. It is must to mention that if an individual is required to have TAN and is not having TAN, then there is a penalty of Rs 10,000 on that individual.

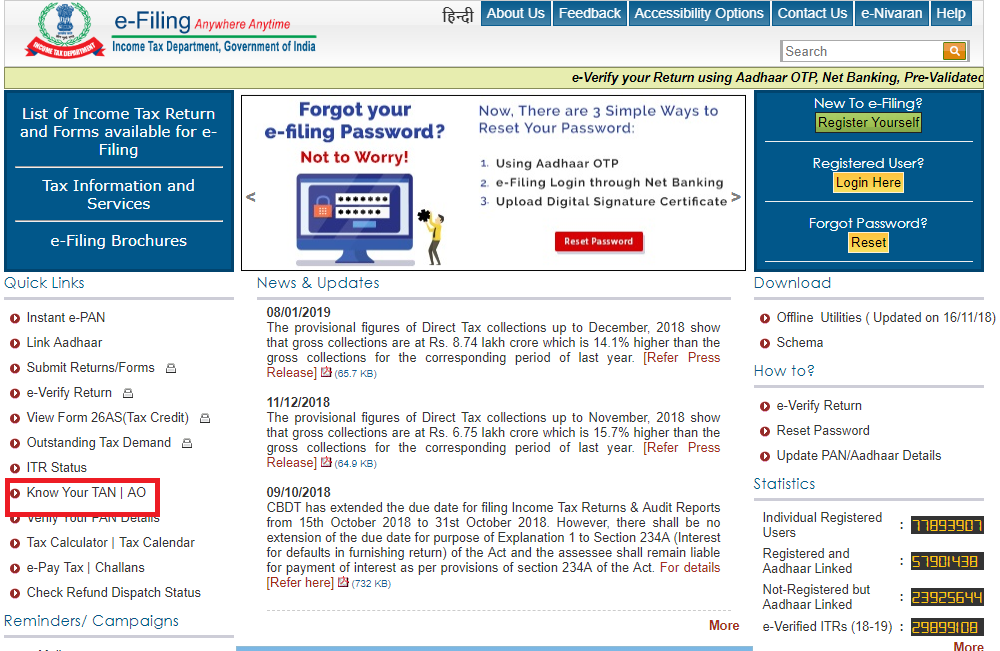

An applicant can know the TAN details either by providing the name or TAN. In case, an individual has forgotten the TAN, there are steps mentioned below that will help in retrieving the TAN:

Step 1: Visit https://www.incometax.gov.in/iec/foportal/

Step 2: Click on ‘Know Your TAN’

Step 3: Select ‘Name’ under the ‘TAN Search ‘option

Step 4: Select ‘Category of Deductor’

Step 5: Select ‘State’

Step 6: Provide ‘Name’.

Step 7: Provide the registered mobile number

Step 8: Click on ‘Continue’

Step 9: Insert the One Time Password (OTP) sent on the registered mobile number on the corresponding screen.

Step 10: Details will be displayed on the corresponding screen.

To know about TAN details, a new user does not have to register on the Income Tax-e-filing website. If an individual still wishes to register himself or herself in availing benefits, the process is as follows:

Step 1

Visit https://www.incometax.gov.in/iec/foportal/

Step 2

Select ‘Register Yourself

Step 3

Next, select the user type in the corresponding screen and click on ‘Continue’

Step 4

Provide the details like PAN, name, date of birth and residential status

Step 5

Click on ‘Continue’

Step 6

Fill in the registration form and click on ‘Continue’. Next, follow the guidelines mentioned in the corresponding screens.

| PAN | TAN |

|---|---|

It is the Permanent Account Number, must possessed by all individuals or entities to file his or her Income Tax Returns. |

Tax Deduction and Collection number is required by those accesses who are liable to make deductions or collect TCS under the Income Tax Act. |

Step 1

Log on to the website of https://www.incometax.gov.in/iec/foportal/

Step 2

Make a selection of ‘Jurisdiction’ under the ‘Important Links’ tab

Step 3

Select the state, on doing so, a PDF file will be generated. TAN jurisdiction building names can be found on the list.