Permanent Account Number (PAN) is a document that holds importance for all the taxpayers. The Company can be anywhere, incorporate in India or abroad, it is a must to have a PAN card for operating business in India. Companies who have originated in India but are making income from outside the country also need to provide PAN details for many reasons.

The Government of India has made a mandate for all entities that are generating income in the country. Whether it is Company, individual business, HUF, Trust or Partnership firms to hold PAN Card.

The process to apply for a PAN card is simple and can be easily done online. All those companies incorporated in India are required to fill to form 49 A to apply for a fresh PAN card for a company.

Step 1

Visit under the section of Paperless PAN application on the portal of NSDL

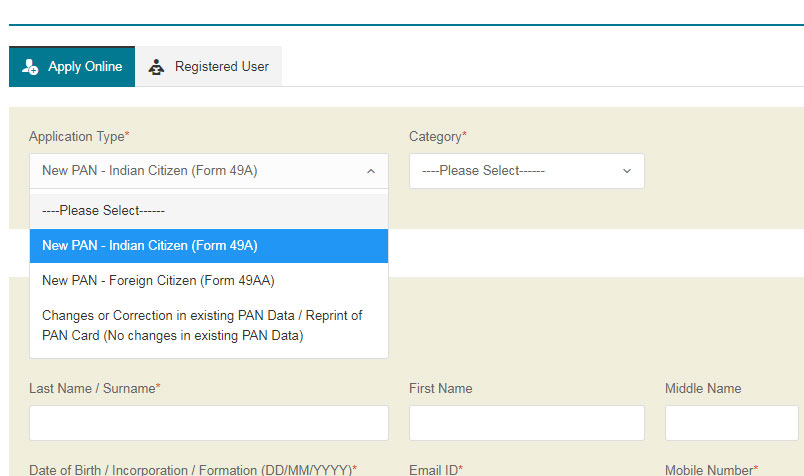

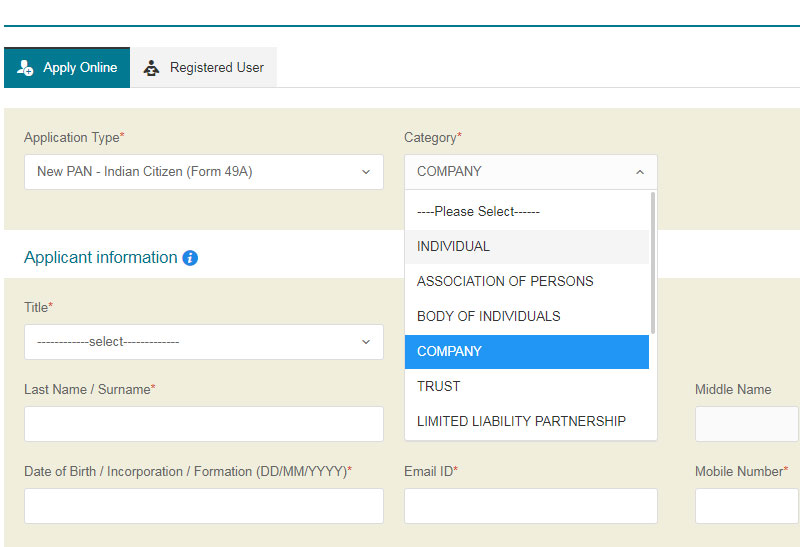

Step 2

Select Form 49A or 49AA from the ‘Application Type’ dropdown menu and select ‘category’ as ‘Company’ from the next dropdown menu.

Step 3

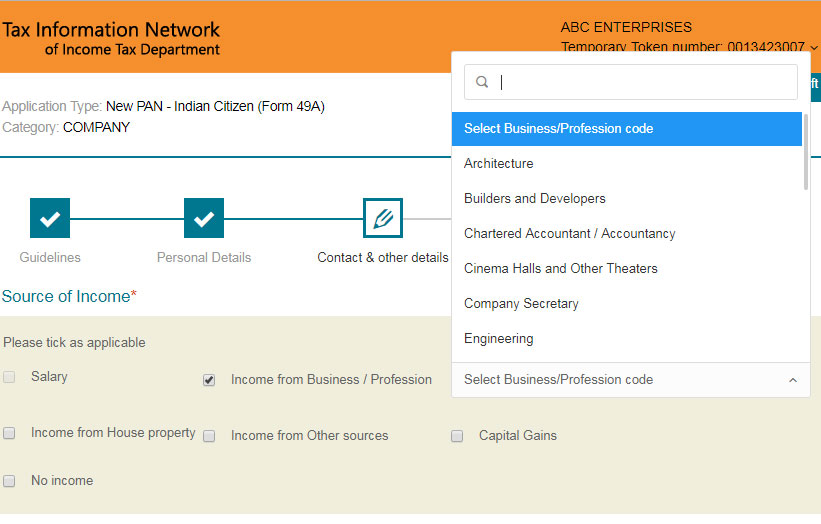

Fill out the required information which is M/s, Details of the company (in the ‘Last Name’), date of incorporation of the company, email address of a company and contact number. After filling all the information, fill the captcha code and proceed. A Token number will be generated and the same being sent to the Company’s email address.

Step 4

When it is applying for Company’s PAN application, the e-sign facility and e-KYC facility will not be available. The name of the company, email address of the company and contact number will already be filled. One must physically complete formalities of completing KYC details and making a manual signature in the form.

In this part, you must mention details regarding the income source. Select from options such as Income from Business / Profession and in case you select business, then also select the type of business. If your source of income is from Capital gains, house property or other sources, then mention the details of that also.

Step 6

After that, the applicant needs to provide details about the office address that also be considered as a communication address in the database of PAN card.

Step 7

Another step is to give the Assessing Officer (AO) code that is being designated as per jurisdiction area of your location. You can select an option’ Indian citizen’ and after that select ‘State’ and ‘City’. Or else you can also go to the ‘AO Code Search for PAN’ page on the NSDL website.

Step 8

You can now proceed to the documentation page.

Step 9

In case of Companies, Certificate of Registration issued by the Registrar of Companies can be used in the form of both address proof and identity proof.

Step 10

After that, the declaration needs to be signed in which the applicant will be asked about its relationship with the company. As either Director or Authorized signatory can apply for the PAN Card of the company. After submitting the form with the declaration, the next step is uploading the scanned copies of the required documents.

Step 11

Once done with the form completion, an applicant should review that all information mentioned in the form is correct or not and after that submit the form.

Step 12

Along with the form submission, an applicant is also required to pay a fee of Rs 110, If the address of communication is within India and Rs 1020 is in the case where the communication address is outside India. The modes of payment available are Demand Draft, Credit card, Debit Card and Net Banking. One needs to make sure that Credit Card, Debit Card or Net Banking should be of the Director.

Step 13

After making a successful payment, acknowledgment receipt will be provided to the applicant to check the status of PAN Card applied for a company. Apart from checking status, a copy of the duly signed Acknowledgment receipt is also sent to the NSDL office in the below-mentioned address with a copy of registration certificate and demand draft (if any).

Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411016

At the time of filing PAN application, companies need to submit some documents as an identity proof and address proof. The Registrar certificate issued by the Registrar of companies act as both address proof and identity proof. Based on entity, below mentioned documents accepted as an identity proof and address proof.

For Companies

Certificate of Registration issued by the Registrar of Companies

For Limited Liability Partnership Firms

Certificate of Registration issued by the Registrar of LLPs

For Partnership Firms

Partnership Deed; or Certificate of Registration issued by the Registrar of Firms

For Trusts

Trust Deed; or Certificate of registration number issued by Charity Commissioner

For Association of persons (other than Trusts) or Body of Individuals or Local authority or Artificial Juridical Person

Agreement; or Certificate of registration number issued by charity commissioner or registrar of cooperative society or any other competent authority; or

Any other document originating from any Central or State Government Department establishing identity and address of such person