When someone applies for a new PAN card, there is one section in the application which asks them to provide AO Code. The full form of AO code is Assessing Officer code which means to mention the jurisdiction under which an applicant falls. This section is in right side at the top of the PAN card form. AO section consists of various other elements. The importance of providing information about AO code and jurisdiction links directly with the taxation. This information will help authorities to understand what tax laws apply to a person.

Note: One needs to ensure that companies and individuals should be taxed according to the appropriate rules and mentioning of AO codes is essential for everyone.

Officers were assigned to each area for the purpose of assessing the taxation of the people. Identification of these officers done with the help of AO Codes. There is a table designed in Form 49A where you can check the AO codes. It is formed with the combination of multiple elements. AO code consist of 4 elements that are mentioned below:

Area Code: Help in the identification of the geographic location of the company or individual. It is a 3-letter area code.

AO Type: It is being introduced to help the tax department for the identification of the category of PAN cardholder; as a company or an individual or service personnel or any person who is not the citizen of India.

Range Type: It is based on to find the permanent address of PAN Cardholder. They are being assigned with a Range type that helps to identify the circle or ward that they live in.

AO number: It is a numerical value which is published on the website of NSDL and is the last element of AO code.

There is a certain criterion that one needs to understand before making the selection of theright AO code. There are two categories based on which you can select a AO code:

First

Individual: If an individual applies for a PAN card whose source of income is either from a business or salary then, in that case, AO code will be either on the office address or residential address.

Second

Non-Individuals: It refers to Trusts, HUFs, Government bodies, LLPs, Companies, etc. For all these cases, the organization considers office address for determining their AO code.

There are mainly four forms of AO codes meant for the identification of company/ individual. For the correct identification of AO Code, NSDL published a list of AO codes which is being separated into the following four categories:

AO code selection will be based on your section and address criteria. There are certain steps that one needs to follow to get an AO code:

| AO Code for Bangalore | |

| AO Code for Delhi | |

| AO Code for Hyderabad | |

| AO Code for Mumbai | |

| AO Code for Chennai |

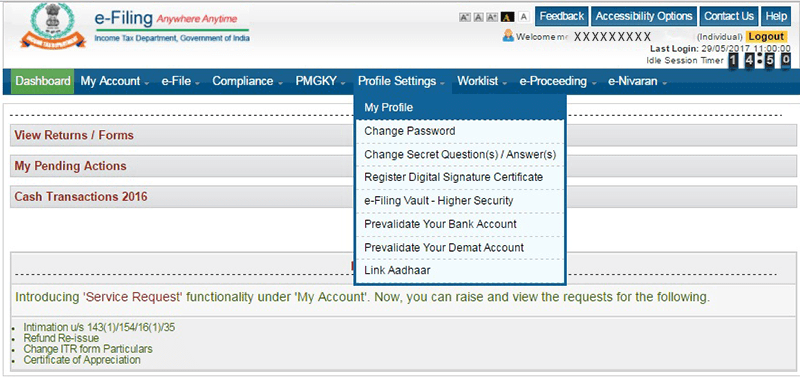

Visit the website and log in to the following site https://www.incometax.gov.in/iec/foportal/

After that click on the ‘Profile Settings’ and click on the section’ Profile’.

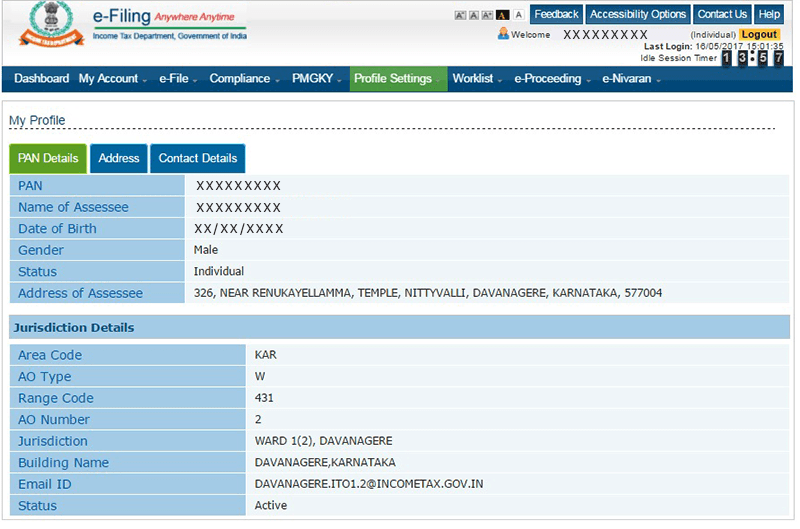

After that click on ‘PAN Card’, it will display all information of PAN along with information about Area Code, AO type, Range Code, Area number.

Note: It is always being advised to double check the Area Code so that incorrect information not sent to PAN issuance authorities.

When your PAN is being migrated under new Assessing officer (A.O.), you need to be clarified about few things: