Tax Deduction Account number or Tax collection Account Number which is a 10-digit number. It is issued by the Income Tax Department of India. TAN is required to have by all those individuals who were responsible for doing tasks such as collecting of tax at source or deducting of tax at source.

Step 1

Log on to the website of Visit https://www.incometax.gov.in/iec/foportal/

Step 2

Make selection of Online Application for making correction or changes in TAN Data or TAN change request form.

Step 3

Fill online TAN Change request form and submit the form. It is mandatory to fill all the field that is marked with*. After that select the corresponding box on the left margin of appropriate field where correction is required.

Step 4

If that TAN data submitted by the applicant fails in any format level validation, then there will be a message appear on the screen which states the error(s).

Step 5

After rectifying the error, TAN application forms need to be re-submitted.

Step 6

In case, any of the applicants required any amendment to the TAN data the displayed in the confirmation screen, it may choose the edit option. In case, displayed information is correct, the applicant can choose the confirm option.

Step 7

After making a successful payment of fees, in case mode of payment is other than demand draft or cheque, an acknowledgment slip will be generated.

Step 8

Applicant shall save and print the acknowledgment and send it to along with requisite documents to NSDL at

NSDL e-Governance Infrastructure Limited,

5th floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

Model Colony,

Near Deep Bungalow Chowk,

Pune – 411016

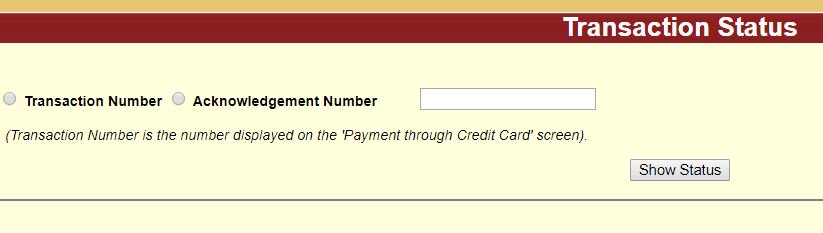

Step 9

The applicants may track/check the status of their TAN application using the unique Acknowledgment Number after three days of the request. The status of the TAN application can also be followed by sending an SMS – NSDLTAN to 57575.

TAN Card correction charges is ₹ 55 + (Goods and Service Tax, as applicable) to NSDL e-Gov/TIN-FC as processing fees while submitting your application at the TIN-FC or making online application.

1) TAN change request can be made for 'change of category of the applicant' only if category is inaccurately mentioned in the database of the Income Tax Department (ITD).

2) For cancellation request, TAN to be cancelled should not be same as TAN (the one currently used) mentioned at the top of the form.