Permanent Account Number is a 10-digit alphanumeric code that is unique to every holder. Every PAN cardholder is being connected with the Assessing Officer. The Accessing code depicts the PAN jurisdiction, commissioner charge circle/ward.

Many websites provide information about the jurisdiction of PAN of the given PAN number of any individual. PAN Card jurisdiction provides detailed jurisdiction details after the PAN number is being entered on the official website.

PAN jurisdiction offers full-fledged details of the

For instance, if an individual applies for a PAN card and is being allotted by the Income Tax Department based on permanent address which is mentioned in the PAN application form, they can also check the PAN card status.

In case, if an individual wants to change their permanent address and want to communicate same to the IT Department on this change, then in that case individual also needs to change his or her PAN jurisdiction. It lies with the jurisdictional Assessing officer.

With the help of PAN jurisdiction, you can change or shift your permanent address easily. Individuals by visiting on the website of the Income Tax Department get to know your PAN easily.

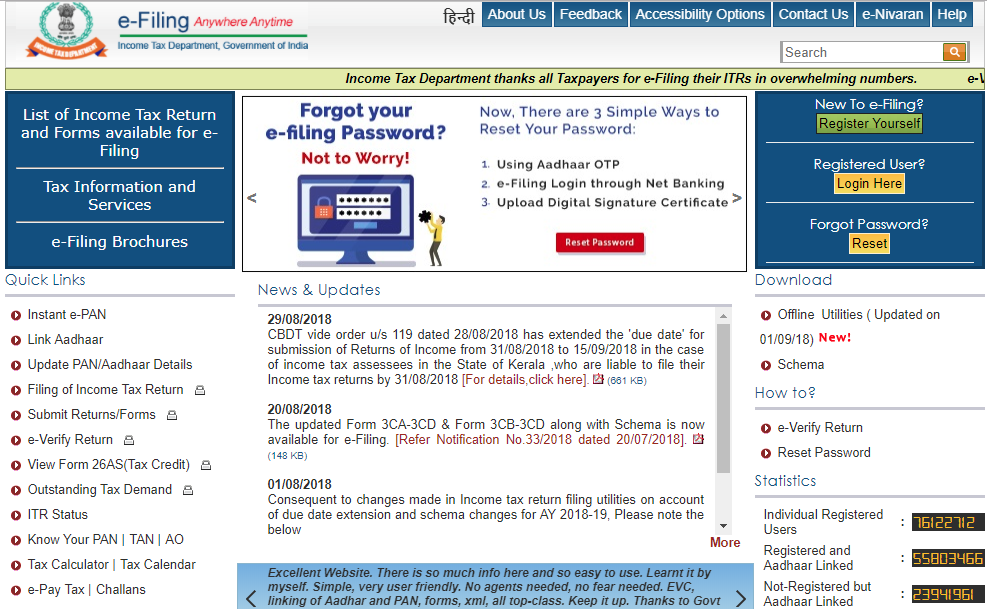

Visit the official website of Income Tax at https://www.incometax.gov.in/iec/foportal/

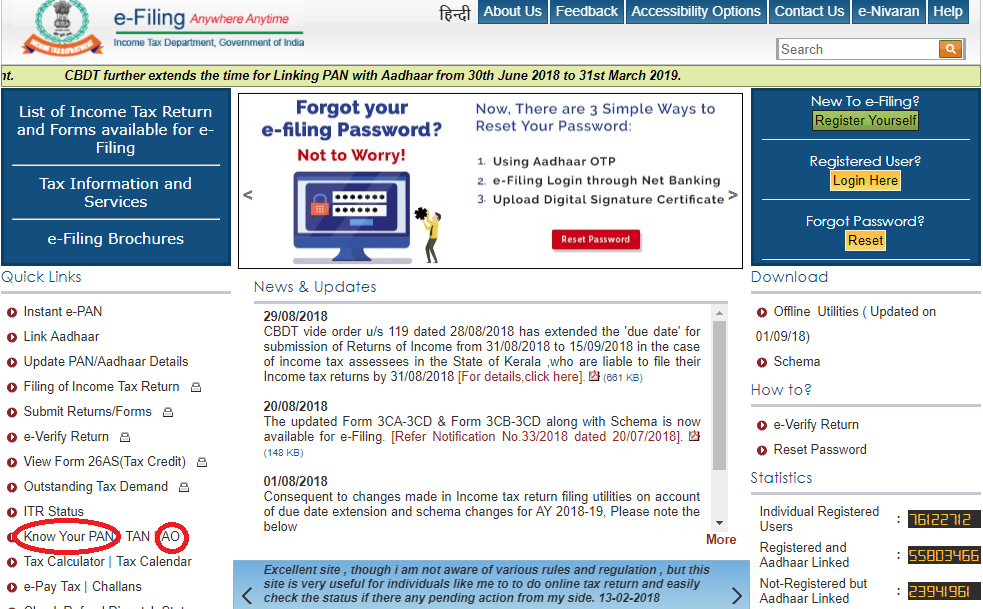

Select “Know Your PAN/TAN/AO”

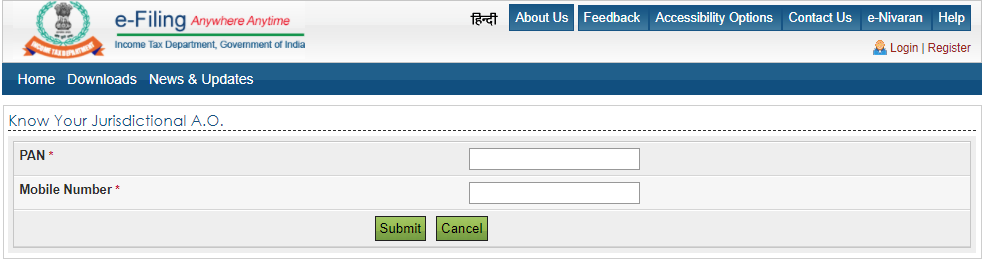

Enter “PAN Number” and “Mobile Number” and then click “Submit’’

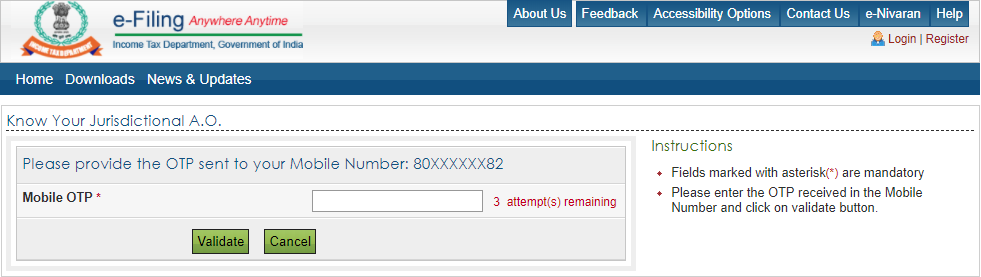

Enter the OTP received on your registered mobile number and click “Submit”

PAN jurisdictional details will be displayed on the screen for the concerned PAN number.

Step 1: Visit the official website of NSDL at https://www.tin-nsdl.com

Step 2: Click on “PAN” under ‘Services’ section

Step 3: Click “Apply” under “Changes/Correction in PAN Data”

Step 4: Fill up the required details carefully along with the necessary documents

Step 5: You will be redirected to the payment gateway page. Pay the required amount and submit

Step 6: You will be provided new PAN card with the new Assessing Officer code with 15 days of the form submission.