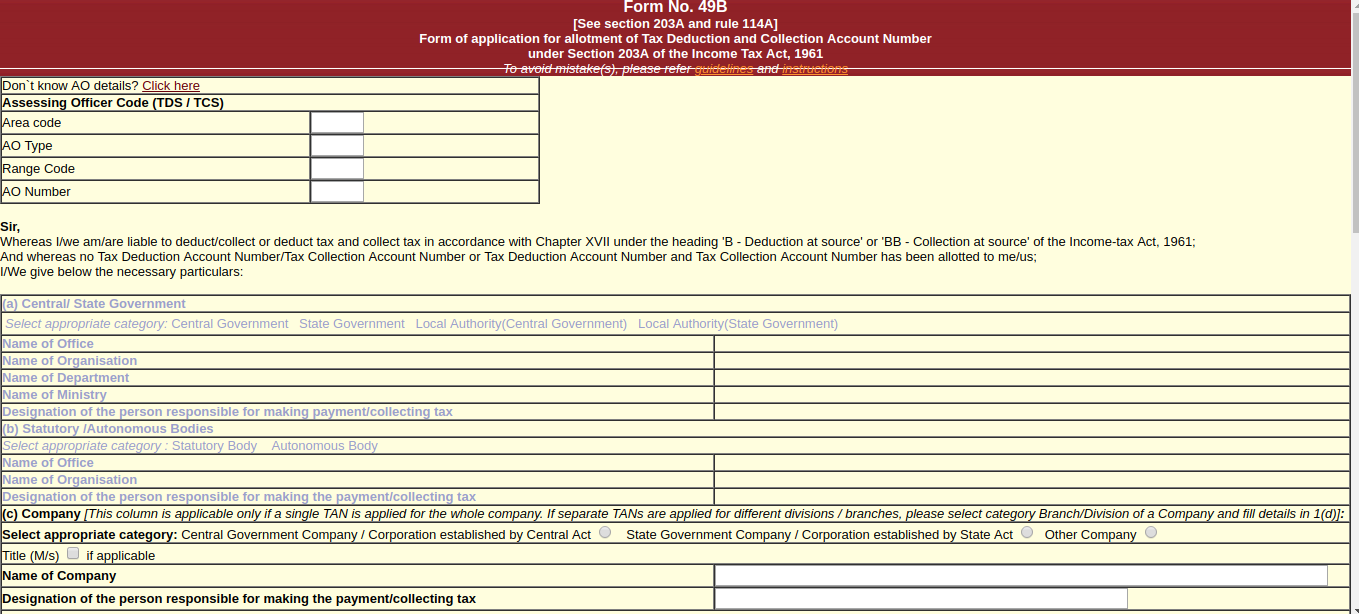

TAN application Form 49 B is a form through which individuals can apply for a new Tax deduction and Collection number. This Form 49 B can be obtained either by visiting the Income Tax department office through online at the Income Tax official website.

Step 1

Go to the official website by using the link: www.tin-nsdl.com/index.html

Step 2

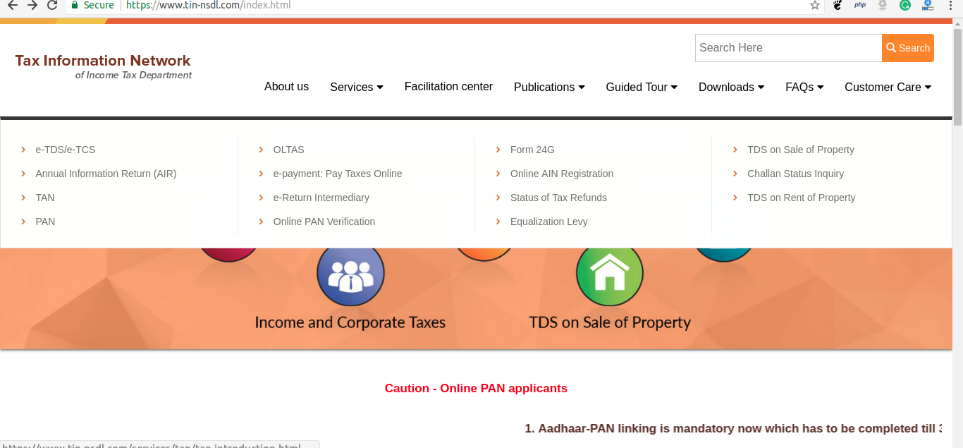

Make selection of option’ TAN’ under services dropdown.

Step 3

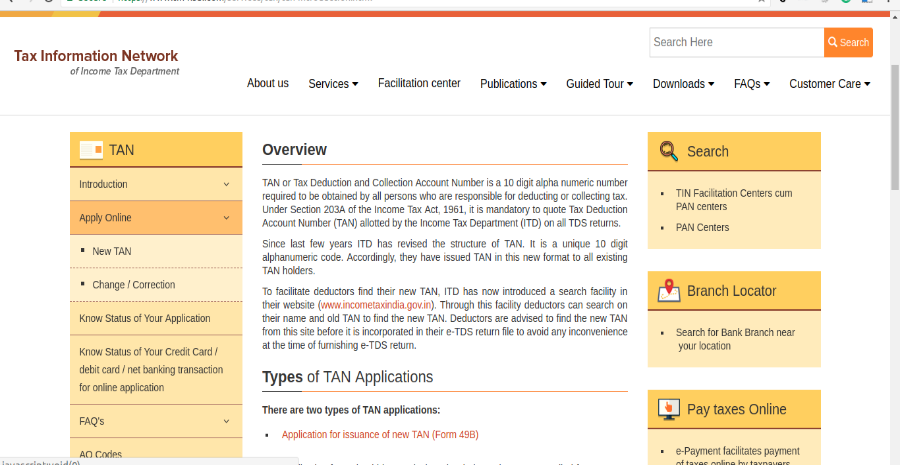

Click on apply online, choose option, ‘New TAN’

Step 4

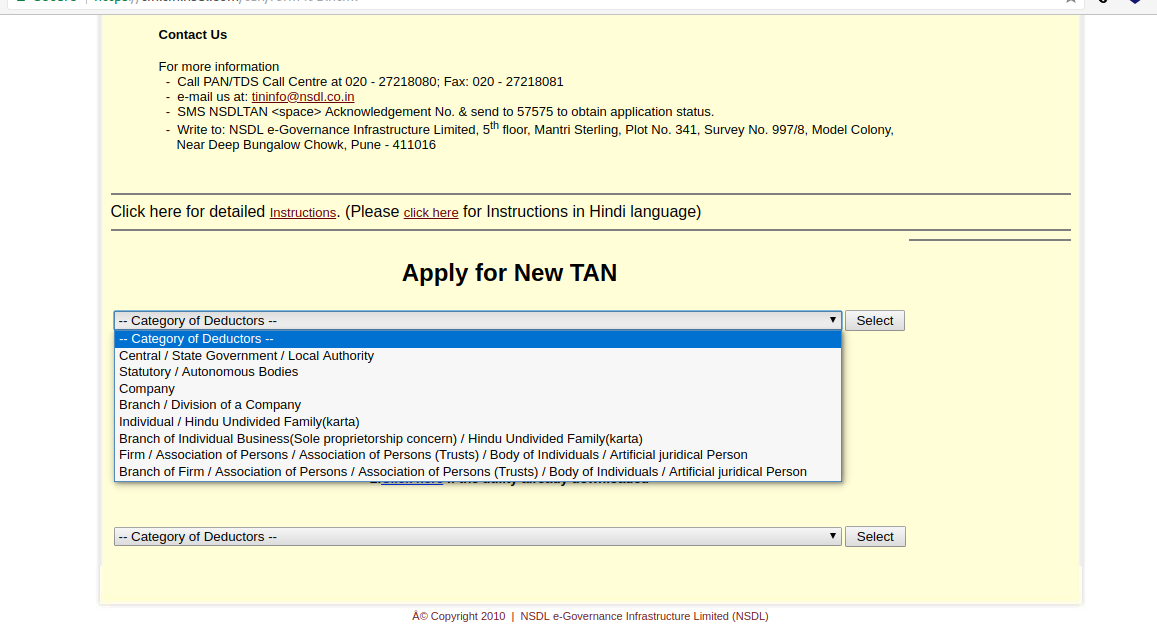

From the given list, choose from the list ‘category of deductors’

Step 5

Now, click on ‘Select’.

Step 6

After doing the so, you will be redirected to Form 49B.

Step 7

Next step is to fill in the Form 49 B and click on ‘Submit’.

Step 8

As soon as you click on the “Submit button”, an acknowledgment screen will be displayed which contains the following:

Step 09

Now, you are required to save the acknowledgment and get a printout of it.

Step 10

Now, the printout of the acknowledgment along with other documents is required to be sent to NSDL at –

NSDL e-Governance Infrastructure Limited

5th floor, Mantri Sterling

Plot No.341, Survey No.997/98,

Model Colony

Near Deep Bungalow Chowk

Pune – 411016

Form 49 B can be downloaded from the official website of the Income Tax Department. One can also get Form 49B from TIN- facilitation Centers. One can take the address of TIN facilitation Center from the NSDL site https://www.tin-nsdl.com.

For offline, there is no need to submit any document. If the application is online, then an individual need to duly signed by the acknowledgment generated on successful submission and payment of processing fee towards TAN application. After that, acknowledgment needs to be sent to NSDL-TIN facilitation centers. The address will be available on the acknowledgment slip.

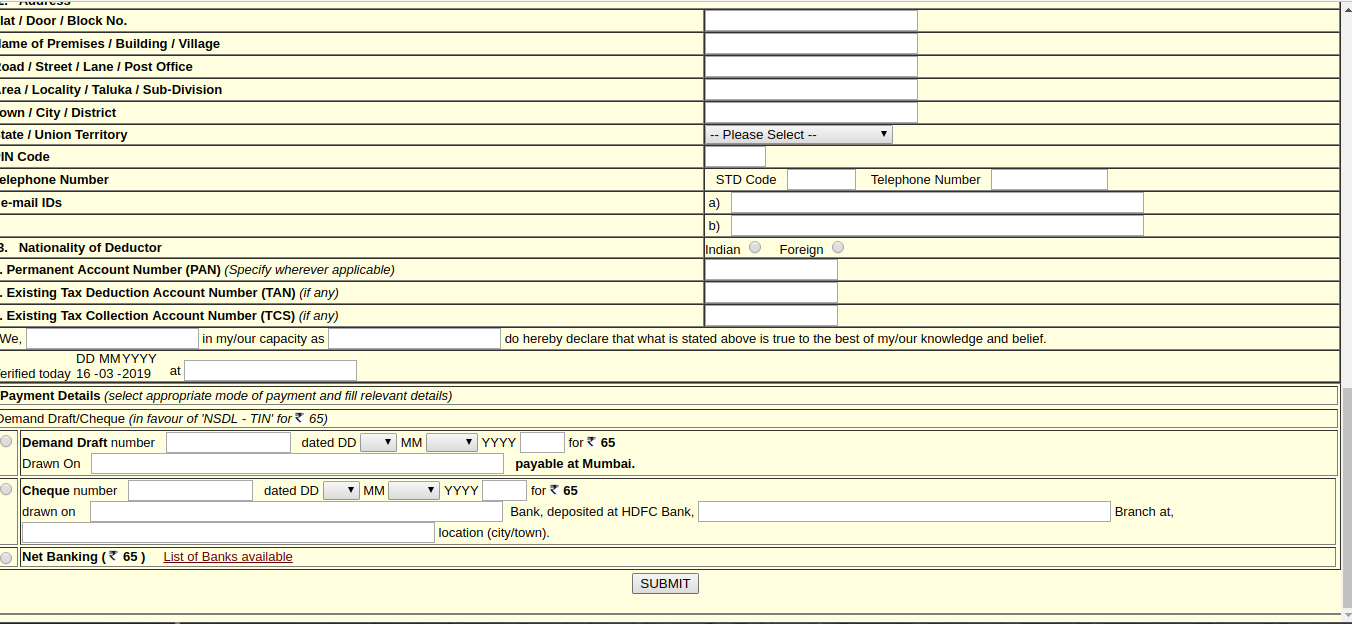

To apply for new TAN, applicants are required to make payment. The fee for the process of TAN application is Rs 65 inclusive of 18% of Goods and Services Tax. Payment can be made using the following modes such as:

If the payment is being made through Demand Draft, it should be drawn in favor of NSDL-TIN payable at Mumbai. It is must mention on the backside of the cheque, name and acknowledgment number and after that please sent it to NSDL office along with acknowledgment slip.

In case, payment made through cheque, the applicant is required to deposit a local cheque of any branch with the HDFC branch across the country except for Dahej Branch. While depositing the cheque, the applicant is making the payment must mention ‘TANNDSL’ on the deposit slip.

Payment made through Debit Card or Credit Card or Net banking facilities are not available for applicants who fall under the below-mentioned category:

Those who are authorized to make Debit Card/ Credit Card or Net banking payment

| Category of the Applicant | Authorized person whose credit card/debit card/net banking can be used for making the payment |

|---|---|

Company/Branch /Division of a Company |

Any Director of the Company |

Individual (Sole Proprietorship)/Branch of individual |

Self |

Hindu Undivided Family |

Karta |

Firm/ Branch of the Firm |

Any Partner of firm |

Association of Persons/Body of Individuals/ Association of Persons (Trusts)/Artificial Juridical Person |

Authorized signatory covered under section 140 of Income Tax Act, 1961 |